Hoffmann’s work to advance ESG, Agenda 2030, and a great reset of the global economic system aligns neatly with his new position at the WEF: perspective

Following the World Economic Forum (WEF) announcement to appoint interim co-chairs, much of the public focus has been on BlackRock CEO Larry Fink, but not so much on Andre Hoffmann, who is a Swiss billionaire and heir to the fifth largest pharmaceutical company on the planet, Roche.

With last April’s departure of Klaus Schwab from the board of trustees of the organization he founded over 50 years ago, the WEF briefly appointed former Nestle CEO Peter Brabeck-Letmathe as interim chairman.

Fast forward four months to August 15, 2025, and the WEF introduced two new interim co-chairs, billionaires Larry Fink and Andre Hoffmann.

“We believe the Forum can serve as a unique catalyst for cooperation, one that fosters trust, identifies shared goals, and turns dialogue into action”

Larry Fink & Andre Hoffmann, WEF, August 2025

With an estimated net worth of $1.3 billion, Fink is the CEO of the largest asset management company in the world, BlackRock, managing some $11.6 trillion in assets.

And with an estimated net worth of $8.13 billion, Hoffmann is the vice chairman of F. Hoffmann-La Roche, the fifth largest pharmaceutical company by revenue in the world, just behind Pfizer.

Together, Fink and Hoffmann issued a statement saying that “the need for a platform that brings together business, government, and civil society has never been greater,” and that they “believe the Forum can serve as a unique catalyst for cooperation, one that fosters trust, identifies shared goals, and turns dialogue into action.”

The WEF leadership page says that in their work on the board of trustees, “members do not represent any personal or professional interests.”

However, it doesn’t take a genius to figure out that the business dealings of the new interim co-chairs align with multiple WEF agendas, from net zero and ESG to stakeholder capitalism and the UN Agenda 2030.

While Fink is constantly making headlines in mainstream and alternative media alike, Hoffmann himself has flown relatively under the radar — known mostly to those who engage in nature financing and business circles in Europe.

Attempting to profile such a long and complex life as Hoffmann’s in under 2,000 words and from thousands of miles away would be futile and ridiculous, but here we will narrow the focus to take a brief look at some of the organizations that he leads, their histories, what they stand for, and how Hoffmann’s work coincides with the WEF’s agenda for a great reset of the global economy and society.

“We are honored to take on this leadership role on an interim basis at a pivotal time for the World Economic Forum. As the organization moves into a new chapter, we look ahead with clarity, purpose, and confidence in the Forum’s enduring mission”

Larry Fink & Andre Hoffmann, WEF, August 2025

When listening to Hoffmann, his words sound almost identical to that of Schwab’s.

Both talk about the need to move society from shareholder capitalism towards stakeholder capitalism (i.e. the great reset).

Both say that present business practices are too concerned with short-term profits and not long-term solutions for people and planet.

And both champion the United Nations Sustainable Development Goals (SDGs), aka “Agenda 2030.”

Hoffmann’s bio and business dealings are extensive:

- World Economic Forum: Interim Co-Chair of the Board of Trustees

- Chatham House: Senior Adviser

- Club of Rome: Member

- Roche Holding AG: Vice Chairman of the Board of Directors

- Genentech: Board Member

- Systemiq: Board Member

- GIST SA: Board Member

- Hoffmann Global Institute at INSEAD: Founder, Advisory Board Chairman

- Innovate 4 Nature: President

- InTent: Co-founder

- Fondation Tour du Valat: President

- MAVA Foundation (defunct): President

Systemiq, the so-called “system change company,” was established specifically to advance Agenda 2030 and the Paris Agreement, and it aims to do that by designing and building “an economy that provides prosperity for all, stabilizes the climate, and regenerates nature for generations to come.”

These systems include nature, food, energy, materials and the circular economy — the latter of which is the inspiration for the infamous phrase, “You’ll Own Nothing. And You’ll Be Happy,” thanks to the circular economy’s Product as a Service business model.

The Hoffmann Global Institute at INSEAD is also geared towards advancing Agenda 2030: “INSEAD’s Hoffmann Institute is striving to integrate sustainability into the school, and drive alignment of the SDGs to inspire business leaders to create prosperity and value for all.”

Innovate 4 Nature, the so-called “accelerator for nature-positive solutions,” has a portfolio of startups and projects focusing on a wide range of topics including, biodiversity credits, environmental justice, food systems, and once again, the circular economy.

InTent serves as a platform to bring together individuals, organizations and business in a collective effort with the belief that “it is not how we spend money that must change, but the whole system by which value is created.”

GIST is all about data analytics for ESG metrics and scoring.

As a member of the Club of Rome, which is all about systems change, de-growth, de-carbonization, the circular economy, and the redistribution of wealth, Hoffmann’s associations and leadership roles all intertwine with the same agendas.

And Hoffmann is senior adviser position at the UK’s Chatham House, the inspiration behind the Council on Foreign Relations (CFR) in the US.

As we can see, many of Hoffmann’s leadership roles have to do with organizations that deal with nature financing.

But his wealth comes from his family’s 129-year history in the pharmaceutical industry.

Hoffmann is the billionaire heir to the F. Hoffmann-La Roche pharma family fortune via his great-grandfather Fritz who founded the company in Basel, Switzerland in 1896.

As the fifth largest pharmaceutical company in the world, F. Hoffmann-La Roche has been involved in scandals, forced labor, legal battles, and criminal conspiracy throughout its history.

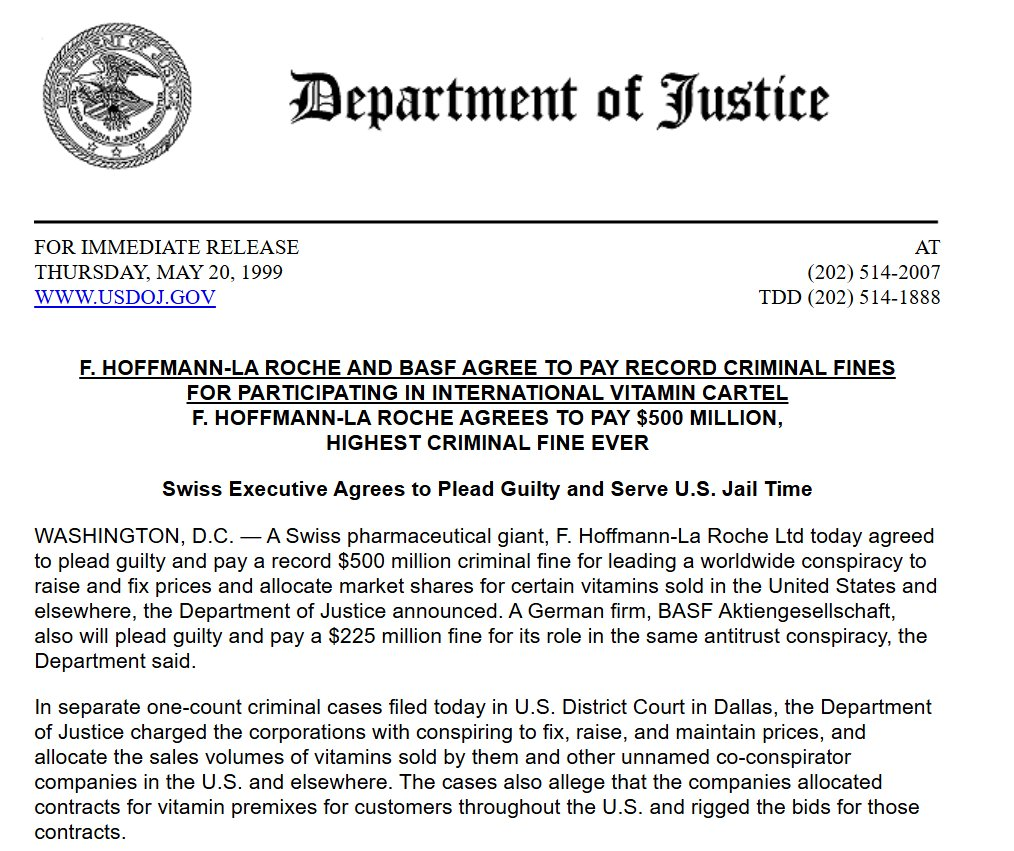

“A Swiss pharmaceutical giant, F. Hoffmann-La Roche Ltd today agreed to plead guilty and pay a record $500 million criminal fine for leading a worldwide conspiracy to raise and fix prices and allocate market shares for certain vitamins sold in the United States”

United States Department of Justice, F. HOFFMANN-LA ROCHE AND BASF AGREE TO PAY RECORD CRIMINAL FINES FOR PARTICIPATING IN INTERNATIONAL VITAMIN CARTEL F. HOFFMANN-LA ROCHE AGREES TO PAY $500 MILLION, HIGHEST CRIMINAL FINE EVER, May 1999

Apart from forcing 61 prisoners of war and 150 foreign laborers to work at its factory in Germany during World War II, Roche pleaded guilty in 1999 for “participating in an international vitamin cartel” and “leading a worldwide conspiracy to raise and fix prices and allocate market shares for certain vitamins sold in the United States.”

Roche paid the highest criminal fine ever at the time, $500 million, for its activities from 1990-1999.

Andre Hoffmann, the WEF’s new interim co-chair, was first elected to the Roche board of directors in 1996.

“Sales of Roche’s Covid-19 tests have helped boost its stock in 2020”

Bloomberg, Switzerland’s Biggest Family Fortune Has Prospered for 124 Years, August 2020

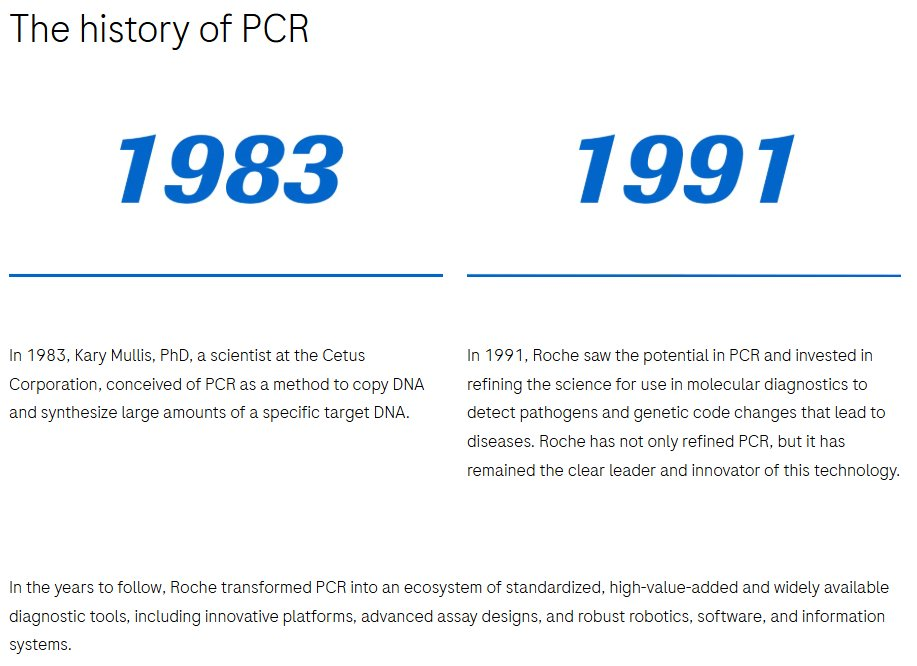

In 1991, Roche invested in Polymerase Chain Reaction (PCR) technology — the same that was later used for COVID-19 testing.

In 1998, Bayer’s Business Group Diagnostics and Roche signed a license agreement granting Bayer non-exclusive, worldwide access to Roche’s PCR patents. “The license gave Bayer the rights to manufacture and market PCR-based human diagnostic products in the infectious disease, genetics, oncology, tissue typing and therapeutic drug monitoring fields.”

Throughout the 2000s, Roche was engaged in legal battles including allegations of PCR patent fraud, as well as patent rights infringement claims “relating to the technology behind electrochemiluminescence immunoassays.”

Does F. Hoffmann-La Roche’s company history of misdeeds define its Vice-Chair and heir?

Not necessarily, but it does provide some context into the world that the new WEF interim co-chair was brought up, and perhaps a glimpse into why he’s so bullish on painting himself as a philanthropist putting patients and planet first.

And it can’t be overstated how influential Andre’s father, conservationist Hans Lukas “Luc” Hoffman, was in his life.

Luc Hoffmann spent much of his wealth on conservation efforts; he founded the Tour du Valat to preserve wetlands in 1954, he co-founded the World Wildlife Fund (WWF) in 1961, and he founded the now-defunct MAVA Foundation in 1994.

Following in his father’s footsteps while still holding on to his great-grandfather’s pharma wealth, Andre would go on to become president of both Tour du Valat and MAVA.

Hoffmann’s wealth spans generations, but now, he wants to overturn all the systems that allowed his family to prosper for over a hundred years.

Is it overcompensation for Roche’s storied past? Is it a desire to follow in his father’s footsteps?

Could it be a mixture of both — a feeling of guilt for being born into a life of privilege and a desire to make his father proud?

Who knows?

Why do self-proclaimed communists often come from rich families in capitalist societies while people who come from poor families in communist countries always want to flee?

Maybe he’s just a nice guy trying to do some good in this world like all the other philanthropists.

As it stands, Hoffmann and Fink are now the WEF interim co-chairs.

Fink’s BlackRock is currently embroiled in a legal battle over allegedly participating in a conspiracy to form a cartel to rig the coal market, similar to what Hoffmann’s Roche did in the 1990s with vitamins.

In November 2024, Texas Attorney General Ken Paxton sued Blackrock, Vanguard, and State Street, “for conspiring to artificially constrict the market for coal through anticompetitive trade practices.”

Allegedly, “BlackRock, Vanguard, and State Street utilized the Climate Action 100 and the Net Zero Asset Managers Initiative to signal their mutual intent to reduce the output of thermal coal, which predictably increased the cost of electricity for Americans across the United States.

“These firms also deceived thousands of investors who elected to invest in non-ESG funds to maximize their profits. Yet these funds pursued ESG strategies notwithstanding the defendants’ representations to the contrary.”

Now that Andre Hoffmann is interim co-chair of the WEF board of trustees, it remains to be seen how long he and Fink will remain at the top, but their past and present work towards advancing ESG, Agenda 2030, and a great reset of the global economic system aligns perfectly with their new positions at the World Economic Forum.

If there’s anyone who can make good on turning dialogue into action at the WEF, it’s these two billionaires.

Image source: Screenshot of Andre Hoffmann from the Luc Hoffmann Institute YouTube channel