The weekend before I travelled to Miami for this year’s edition of the annual celebration of our Lord Satoshi (aka the Bitcoin Conference), I hung out in Tokyo. Most of my time was spent ambling around the metropolis eating and drinking the sumptuous creations of a wide range of talented humans. In particular, I drink a lot of coffee – I am an unabashed coffee snob, and Tokyo produces superior cups of black gold.

One morning, I decided to venture to a previously unexplored neighborhood in search of a celebrated coffee roaster I had heard about. I arrived at the venue 30 minutes after it opened, and all the seats inside were already filled with patrons and a queue had formed. By my (apparently naïve) estimation, the line looked pretty short, so I decided to stick around. After about 15 minutes, no additional patrons had been served and the shop was half empty. I thought to myself, “hmm, that’s strange…why hasn’t anyone from the line been let into the shop to order?”

Out walked what I assumed to be the manager, and she was the embodiment of the quintessential Japanese hipster. Her outfit was on point, complete with a baggy top and pants (it’s all about the drape), an oversized tweed vest, and a faux beret. She walked to the middle of the line, and in a soft, respectful, but firm tone, said, “I just want to inform you that the wait will be about 45 minutes. We hand make each cup of coffee one by one because we are committed to creating beautiful coffee.” The subtext was, “we are not in any way sorry that you will be waiting a long time outside because our coffee is the shit, and if you don’t like it, you can fuck right off.”

That was my cue to exit stage left, because I had a lunch appointment for some bomb-ass teppanyaki and couldn’t wait all day outside for a cup of coffee (regardless of how delicious it might be). However, I knew I was coming back to try this coffee. My patience paid off, and two days later, I showed up before opening time at their other Tokyo location. To my surprise, the same woman emerged from the store, and remarked, “I remember you from the other day – sorry the wait was so long.” I smiled and expressed my excitement to finally sample their product.

The coffee was sublime. I drank a Panamanian geisha varietal. The brew and roast was excellent. The floral notes sung in the cup, and the anaerobic processing method allowed the flavors to punch hard. My patience paid off, and my taste buds thanked me.

Patience is also required in the financial markets. Since the onset of this year’s US banking crisis, I and others have been banging on our proverbial drums and shouting to all who will listen that when it comes down to it, the US and global fiat banking systems will be bailed out by a fresh round of central bank-driven money printing (which should in turn drive up the price of risk assets). However, after the initial spike in Bitcoin and gold, these hard monetary assets have given back some of their gains.

With respect to Bitcoin, volatility and trading volumes across spot and derivatives have sagged. Some have begun to wonder why, if we are truly in the midst of a banking crisis, Bitcoin hasn’t continued rising. And in a similar vein, why the US Federal Reserve hasn’t started cutting rates, and why yield curve control hasn’t started in America.

My answer to those sceptics? Patience. Nothing goes up or down in a straight line – we zig and we zag. Remember “Kaiseki” the destination is known, but not the path.

Money printing, yield curve control, bank failures, etc. will all come to pass, starting in America and eventually spreading to all major fiat monetary systems. The goal of this essay is to explore why I believe the fireworks and the real Bitcoin bull market will begin in the late third and early fourth quarter of this year. Between now and then, chill the fuck out. Take a vacation, and enjoy nature and the company of your friends and family. Because come this fall, you better be strapped into your trading spaceship, ready for liftoff.

As I have said many times, the Bitcoin price is a function of fiat liquidity and technology. Most of my essays this year have focused on global macro events that influence the fiat liquidity side of the equation. I hope that during the lull of the northern hemispheric summer, I can transition to writing about exciting things happening on the technological front of Bitcoin and crypto more broadly.

The goal of this essay is for readers to come away with a solid road map of how the fiat liquidity situation will evolve in the coming months. Once we are comfortable with how USD and fiat liquidity will expand into year end, we can focus completely on what technological aspects of the certain coins are most exciting. When you combine “money printer go brrr” with truly innovative technology, your returns will vastly outstrip the cost of energy. That is ultimately our ever present goal.

The Premise

The bureaucrats in charge of central banks and global monetary policy believe they can rule a market of over 8 billion humans. Their hubris is ever present in the way they talk about certainties based on economic theories developed in academia over the past few hundred years. But however much they would like to believe they have, these men and women have not solved the monetary version of the Three Body Problem.

When the “debt to productive output” equation gets out of whack, economic “laws” break down. This is similar to how water changes state at what would appear to be random temperatures. We can only know the behavior of water through ex-post observations and experiments, but not by theorizing in an ivory tower. Our monetary masters refuse to actually use empirical data to inform how they should adjust their policies, instead insisting that the theories taught by their esteemed professors are correct regardless of the objective results.

Throughout this essay I will delve into why, contrary to common monetary theory, due current debt to productive output conditions raising interest rates will cause the quantity of money and inflation to rise, not fall. It sets up a situation wherein regardless of which path the Fed chooses, be it to hike or cut rates, they will accelerate inflation and catalyze a general rush for the exits from the parasitic fiat monetary financial system.

As true believers of Lord Satoshi, we want to time our trading around this mass exodus as carefully as we can. I want to hang out in fiat earning a phat yield for as long as I can until it becomes necessary to dump my dollars and go all in on Bitcoin. Of course, I’m engaging in my own form of hubris by believing I’ll be able to divine the most opportune time to jump off the burning ship without catching fire myself. But what can I say? At the end of the day, we are all fallible humans – but we have to at least try to understand what the future might look like.

With that out of the way, let’s move on to some statements of (debatable) fact.

- Every major fiat monetary regime has the same problems, regardless of where they sit on the capitalism to communism economic spectrum. That is, they all are highly indebted, have a declining working age population, and feature a banking system in which the assets of the banks are low-yielding government and corporate bonds/loans. A global rise in inflation renders the global fiat banking system functionally insolvent.

- Due to its role as the largest global economy and issuer of the reserve currency, the US is experiencing those issues more acutely than anyone else, and is in the most dire situation.

- Central banker groupthink is very real, because all senior officials and staffers of central banks studied at the same “elite” universities which teach versions of the same economic theories.

- Therefore, whatever the Fed does, all other central bankers will eventually follow.

Keeping that in mind, I want to focus on the situation in Pax Americana. Let’s quickly run through the players in this tragedy.

Keeping that in mind, I want to focus on the situation in Pax Americana. Let’s quickly run through the players in this tragedy.

The Fed exerts influence using its ability to print money and warehouse assets on its balance sheet.

The US Treasury exerts influence using its ability to borrow money by issuing debt to fund the federal government.

The US Banking System exerts influence using its ability to gather deposits and lend them out to create credit and fund businesses and the government. The solvency of the banking system is ultimately propped up by the Fed and the US Treasury with printed or taxpayer money.

The US Federal Government exerts influence using its ability to tax and spend on various government programs.

Private businesses and individuals exert influence through their decisions on where and how to save their money, as well as through their decision to borrow (or not borrow) money from the banking system.

Foreigners, and specifically other nation states, exert influence through the decisions they make regarding whether to purchase, hold, or sell US Treasury bonds.

By the end of this essay, I hope to distil each of these constituents’ major decisions down into a framework that shows how we’ve reached a point that leaves each actor with very little room to maneuver. This lack of flexibility allows us to forecast with high confidence how they each will respond to the current monetary issues of Pax Americana. And finally, because financial crises are still very attuned to the cycle of agricultural harvests, we can be fairly certain the market will wake up and realize shit is fucked right on cue in September or October of this year.

The Harvest

Bear with me, as I have just a bit more setup before we jump into the details. I am going to lay out a few axioms that I believe will occur by or intensify into autumn.

Inflation will reach a local low this summer and re-accelerate into the end of the year.

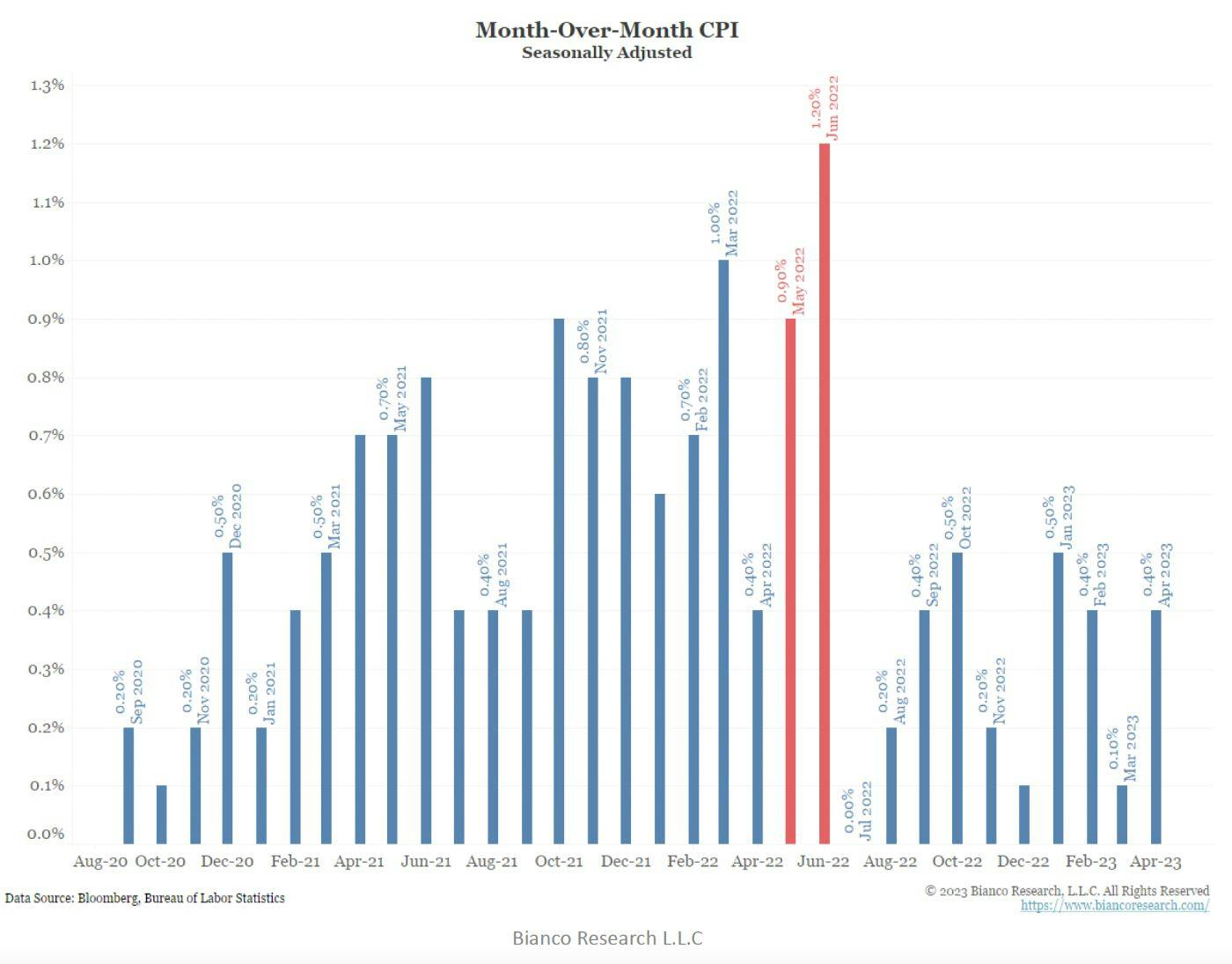

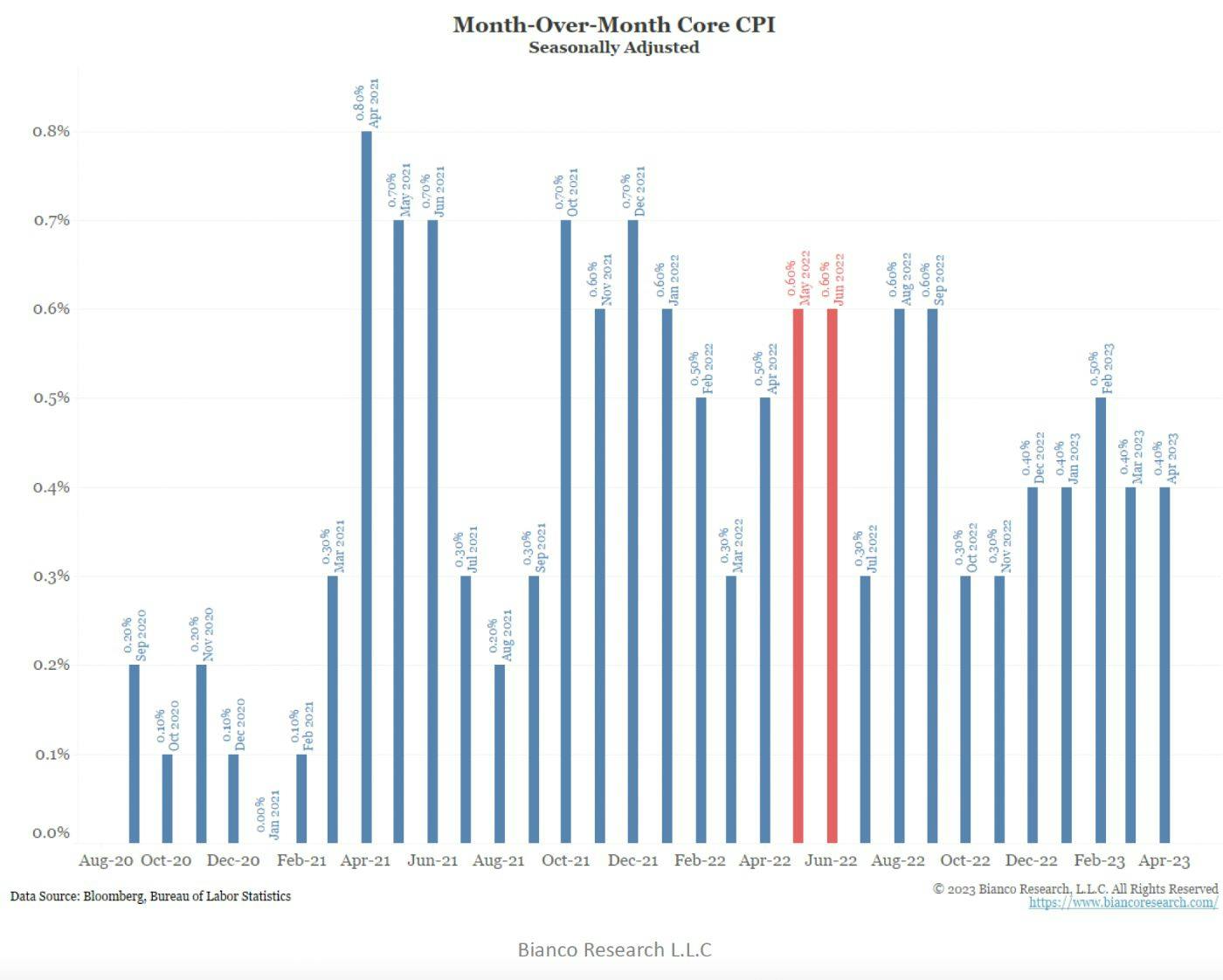

I am talking specifically about US Consumer Price Inflation (CPI). Due to the statistical phenomenon known as the base effect, the high month-on-month (MoM) inflation readings of 2022 will drop out to be replaced with lower MoM inflation readings of summer 2023. If June 2022 CPI MoM inflation was 1% and it is replaced by June 2023 CPI MoM inflation of 0.4%, then YoY CPI declines.

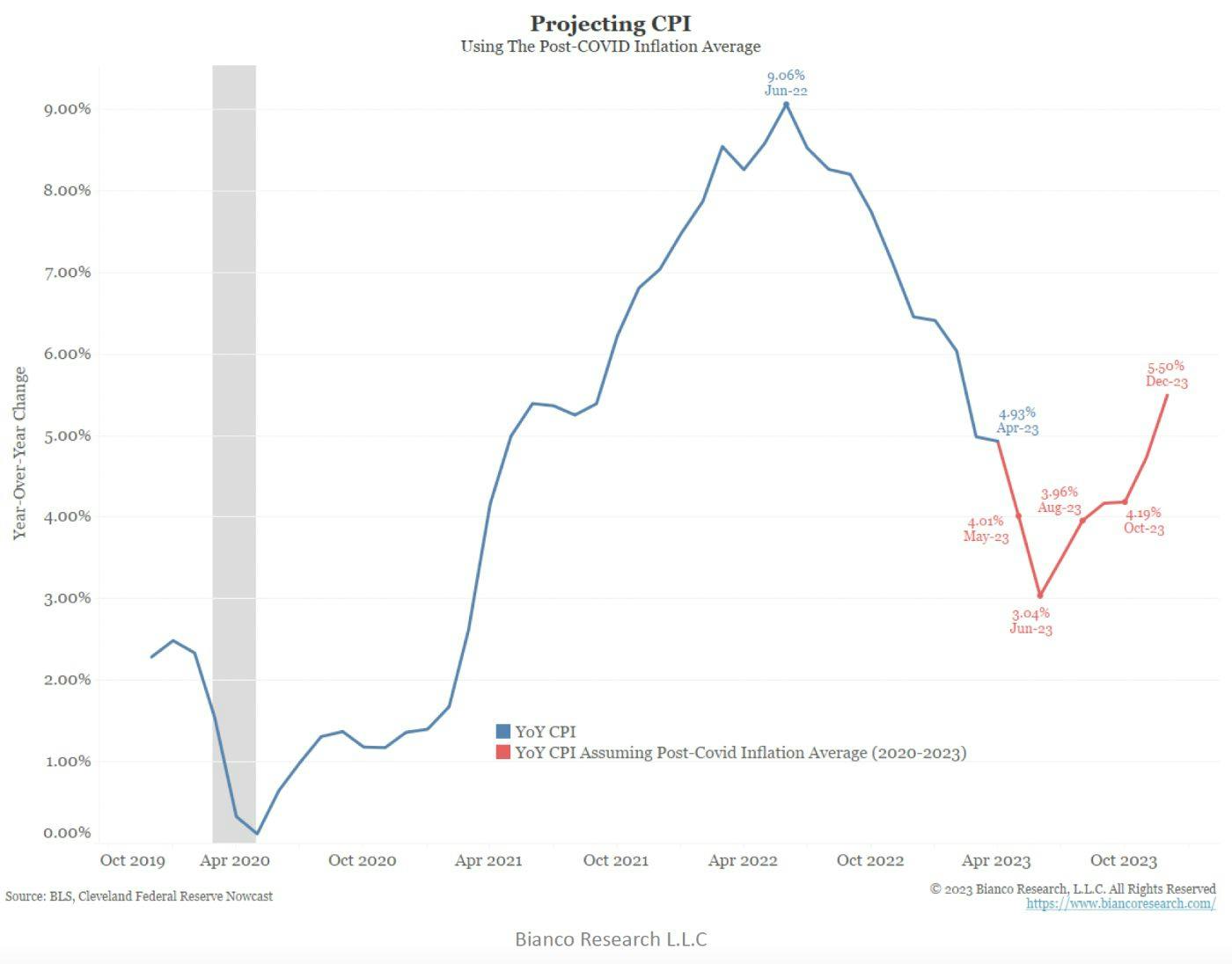

As the chart above shows, some of the highest MoM CPI prints of last year (which are accounted for in the current YoY data) occurred in May and June. For 2023, MoM CPI has averaged 0.4%, which means if we just take the average and replace all readings from May to December 2022 with 0.4%, we get the following chart:

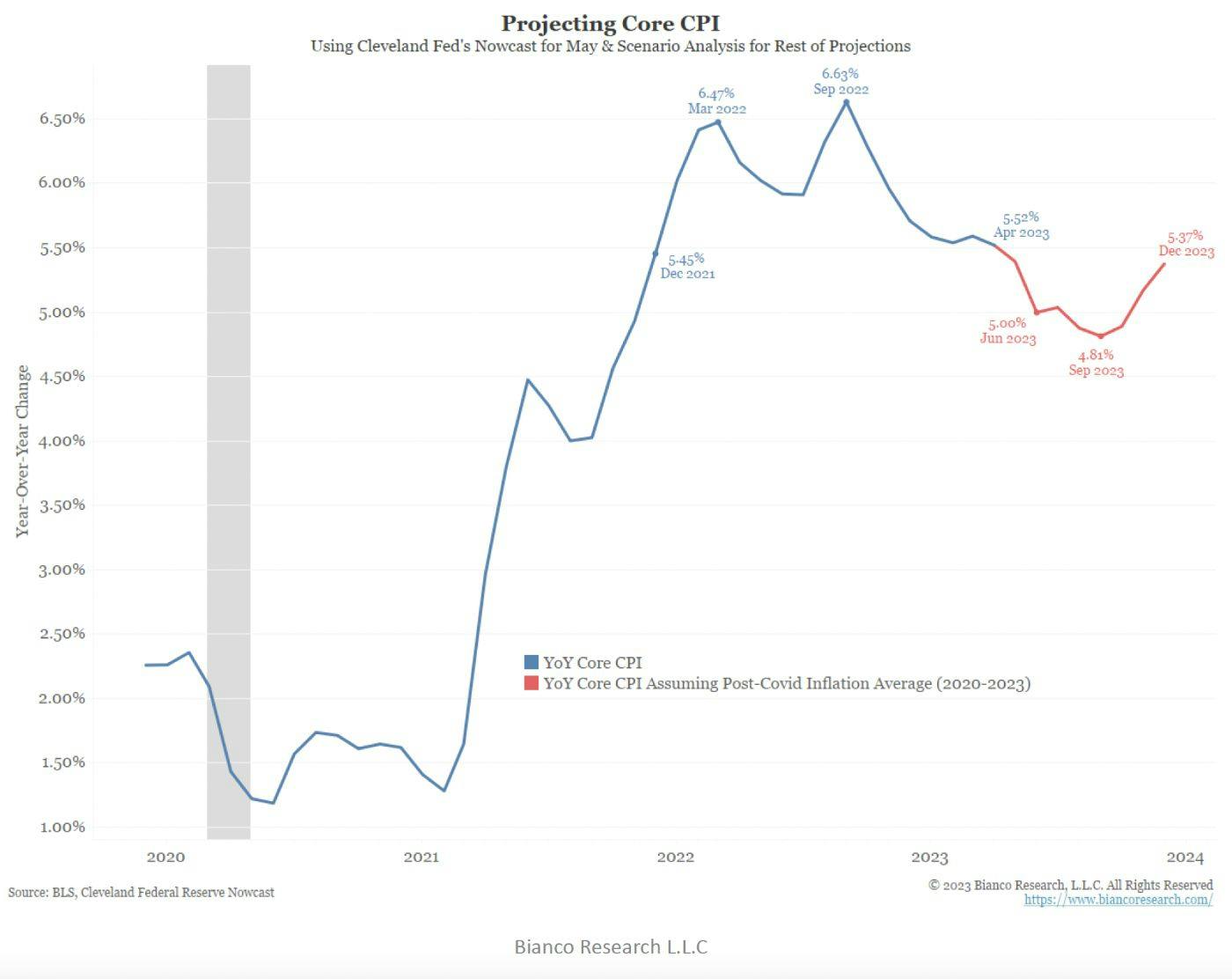

The Fed doesn’t care about real inflation – they care about this make-believe thing called “core inflation,” which strips out all the stuff people actually care about (like food and energy). The below chart conducts the same analysis for core CPI:

The takeaway is that the Fed’s 2% core inflation target ain’t happening in 2023. Which means, if you believe Powell’s and other Fed governors’ rhetoric, the Fed will continue to hike. This is important because it means the rates paid to money parked in the Reverse Repo (RRP) and Interest on Reserve Balances (IORB) facilities will continue rising. It will also contribute to higher US Treasury bill (<1 year maturity) rates.

Don’t get bogged down trying to work out why these inflation measures don’t correspond to how prices actually change for you or your family. This is not an exercise in intellectual honesty – rather, we just want to understand the metrics that influence how the Fed adjusts its policy rates.

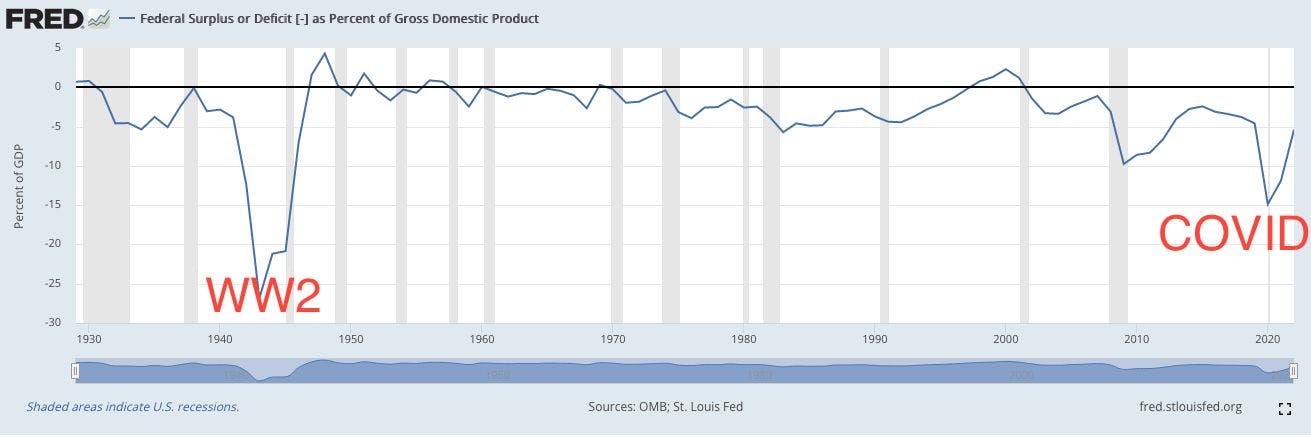

The US Federal Government cannot reduce its deficit due to entitlement spending.

The baby boomers are the richest and most powerful members of the US electorate, and they also are getting older and sicker. That makes it political suicide for a politician to campaign on a platform of reducing boomers’ promised social security and medicare benefits.

For a country that has been at war for almost every year of its existence, it is also political suicide for a politician to campaign on a reduction of the defense budget.

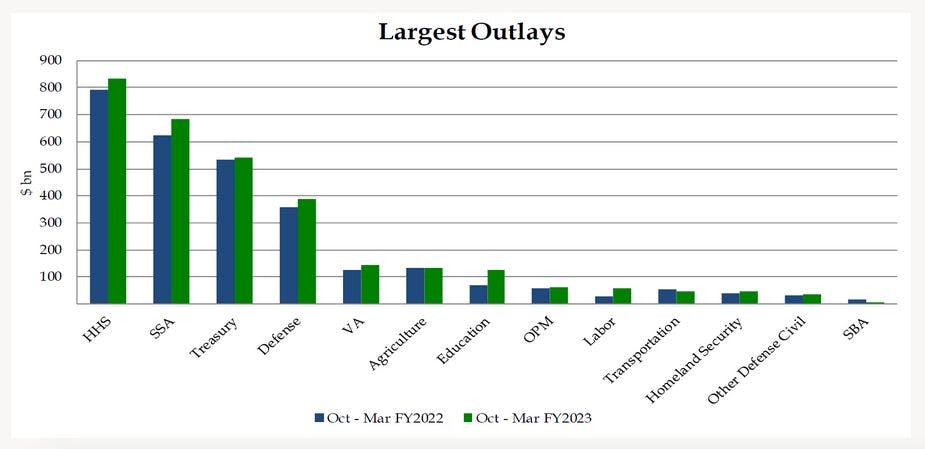

Source: FFTT

HHS + SSA = Old age and medical benefits

Treasury = Interest paid on outstanding debt

Defense = War

Entitlement plus defense spending will only increase into the future. That means the USG’s fiscal deficit will continue rising. It is estimated that deficits of $1 to $2 trillion per year will become the norm in the next decade, and unfortunately there is zero political will on either side of the aisle to alter this trajectory.

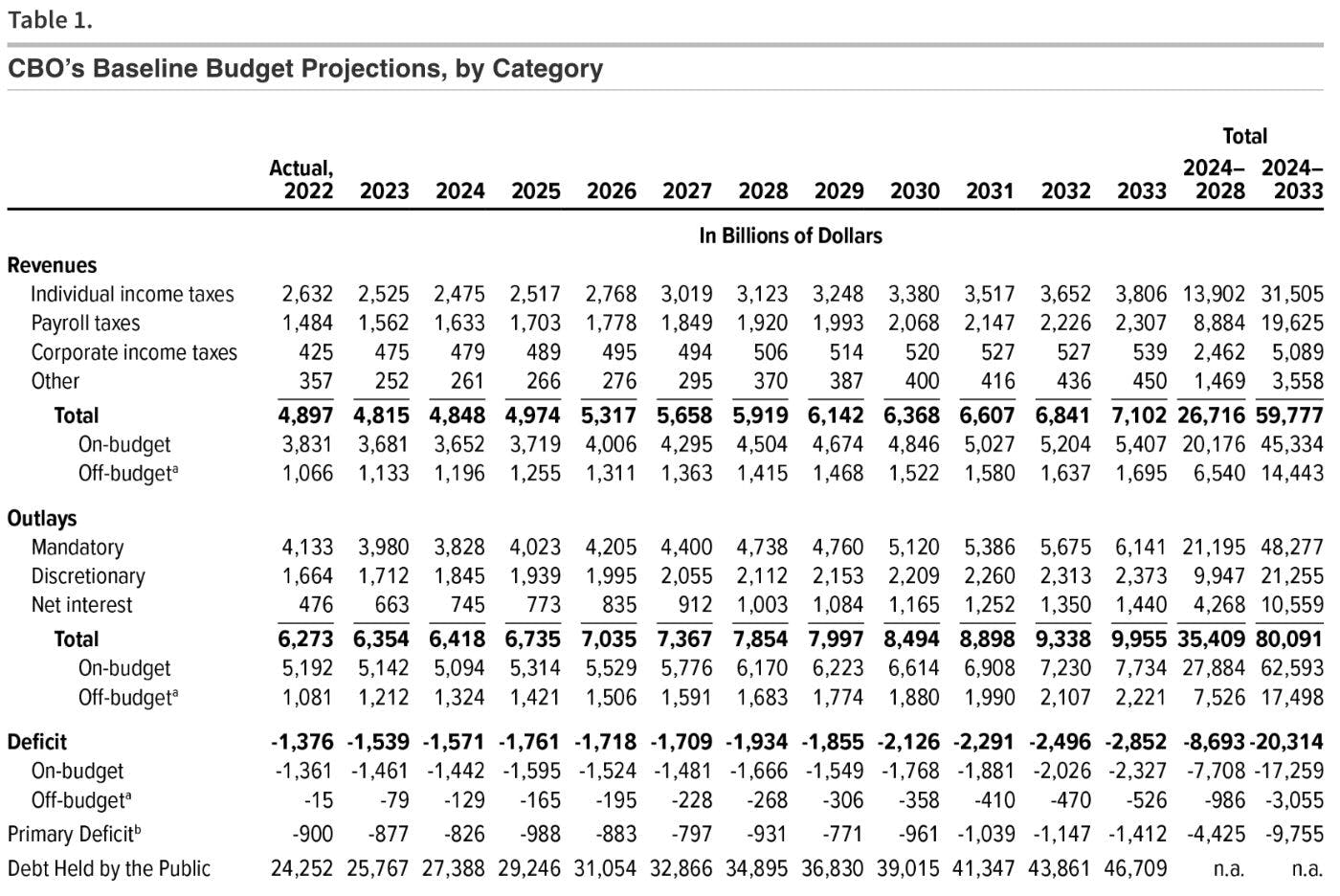

Source: CBO

The end result is a consistent gargantuan flow of debt that the market must absorb.

Foreigners

As I have written about a few times this year, there are many reasons why foreigners have turned into net sellers of US Treasury debt (UST). Here are a few:\

- Property rights are dependent on whether you are a friend or foe of the ruling politicians of Pax Americana. We have already seen the rule of law take a backseat to the rule of national interests, with the US freezing Russian state assets held in the Western financial system due to the Ukraine war. Therefore, as a foreign holder of USTs, you cannot be sure you will be allowed to access your wealth when you need it.

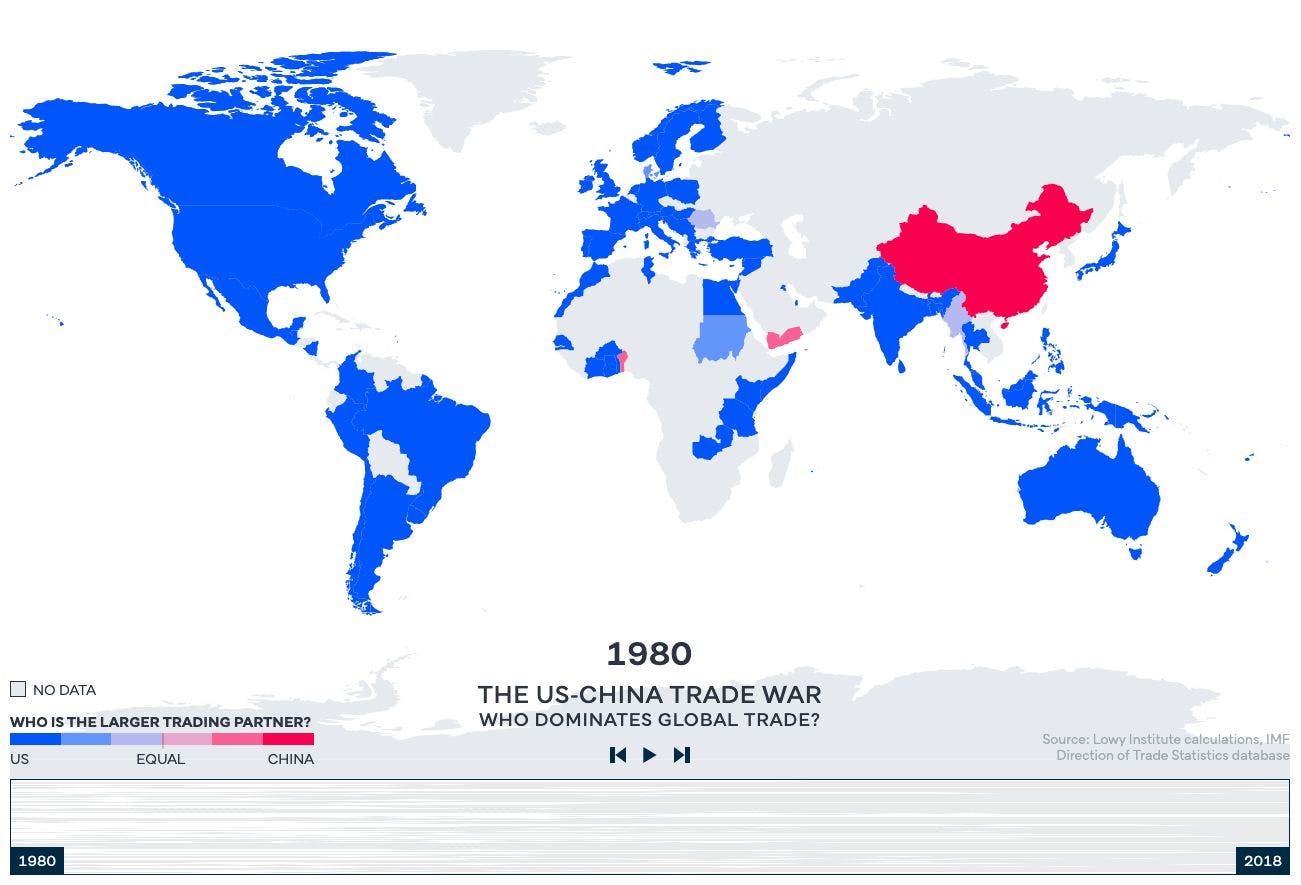

- More countries have China as their biggest trading partner than America. That means that, from a purely trade-driven perspective, it makes more sense to pay for goods in Chinese Yuan (CNY) rather than in USD. As such, more and more goods are being invoiced directly in CNY. That results in lower demand for dollars and USTs at the margin.

- Over the past two decades, USTs have lost purchasing power in terms of energy. Gold has maintained its purchasing power in terms of energy. Therefore, in a world where energy is in shorter supply, it is better to save in gold vs. USTs at the margin.

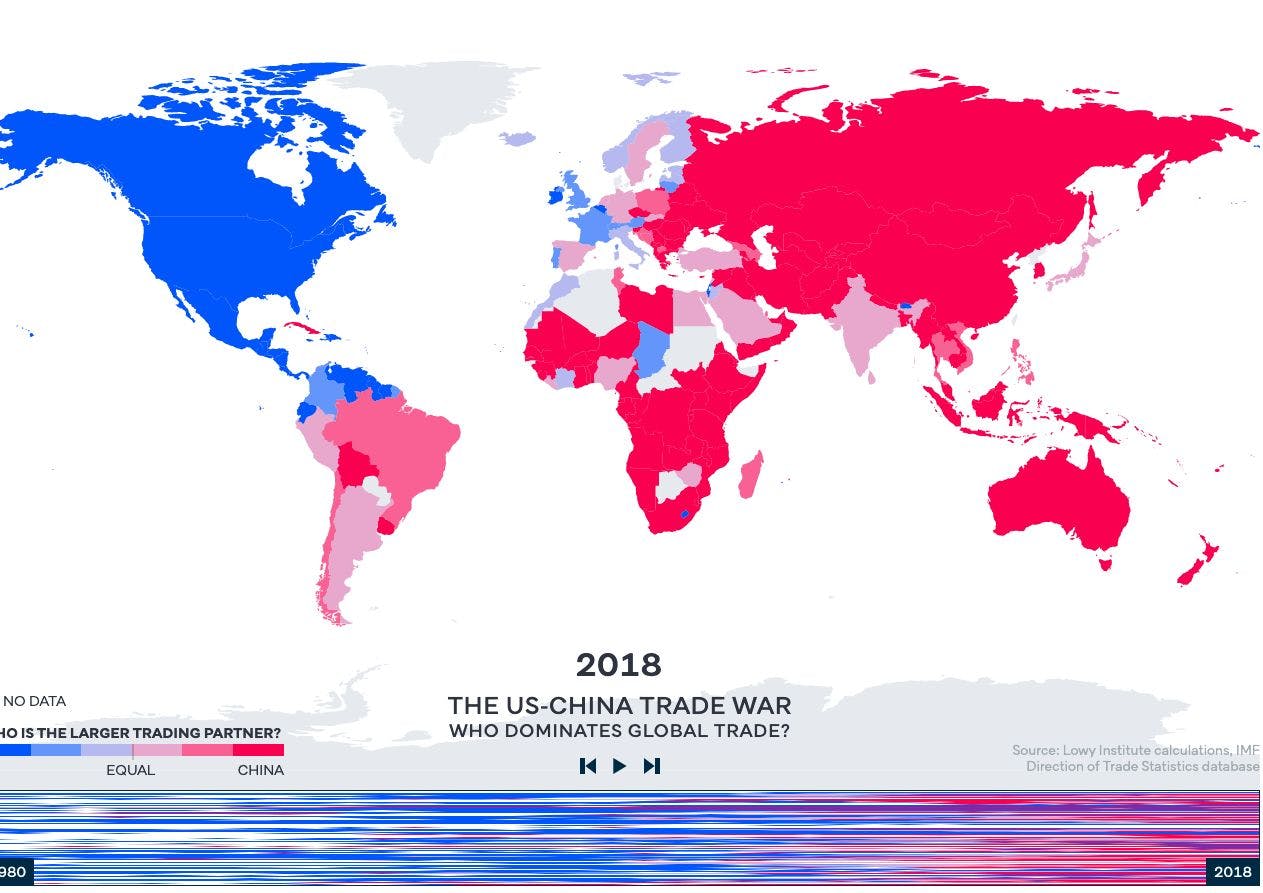

TLT ETF (20-year+ US Treasuries) Divided by WTI Oil Spot Price (white)

Gold Divided by WTI Oil Price (yellow)

Long-term US Treasuries underperformed the price of oil by 50% on a total return basis. But, gold has outperformed the price of oil by 190% since 2002.

The net result of this is that foreign ownership of USTs is falling. Governments outside the US are not buying new issues and are also selling their stock of existing USTs.

TL;DR: if there is a large amount of debt to be sold, foreigners cannot be counted on to purchase it.

US Domestic Private Business and Individuals – The Private Sector

What we are most concerned about with this cohort is what they will do with their savings. Remember that during COVID, the US government (USG) handed out stimmies to err’body. The US provided more stimulus than any other country in order to fight the disastrous economic effects of lockdowns.

This stimulus was deposited into the US banking system, and ever since, the private sector has been spending its free money on whatever it pleases.

The US private sector was happy to keep their money in the bank when yields on deposits, money market funds, and short-term US Treasury bills were all basically 0%. As a result, deposits in the banking system ballooned. But when the Fed decided to fight inflation by raising interest rates at the fastest clip in its history, the US private sector suddenly had a choice:

Keep earning essentially 0% at the bank.

Or

Pull out their mobile banking app and within minutes purchase a money market fund or US Treasury bill that yields up to 10x as much.

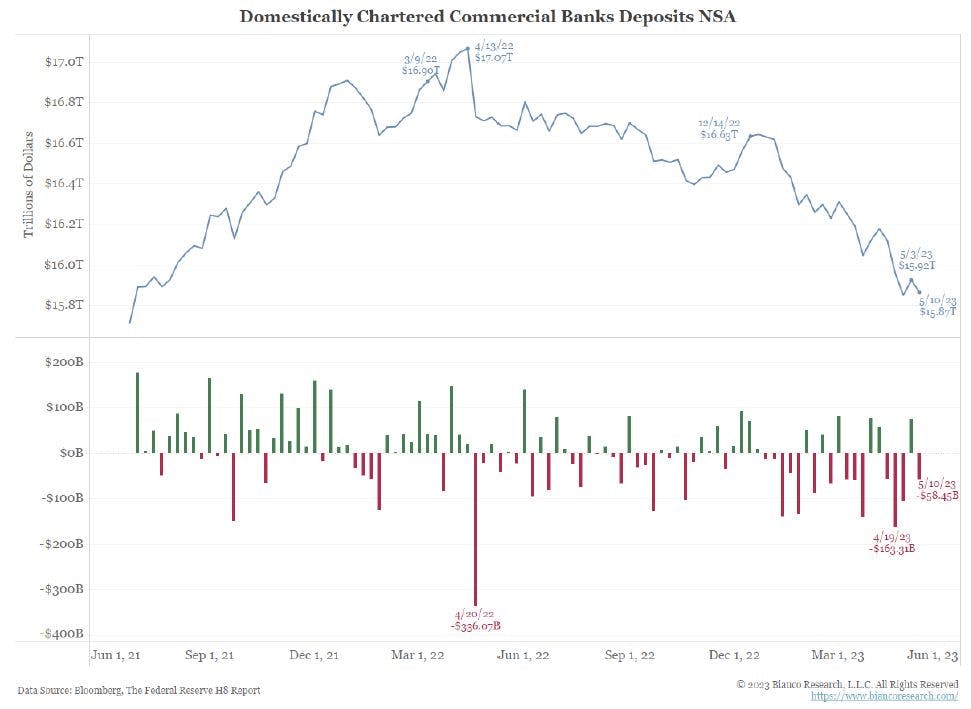

Given that it was so easy to move money out of low-to-no yielding bank accounts into higher yielding assets, hundreds of billions of dollars started fleeing the US banking system late last year?

Over $1 trillion has been removed from the US banking system since last year.

The big question going forward is, will this exodus continue? Will businesses and individuals continue to move money from 0% yielding bank accounts into money market funds yielding 5% or 6%?

Logic tells us the answer is an obvious and resounding “absolutely.” Why would they not, if all it takes is a few minutes on their smartphones to 10x their interest income? The US private sector will continue to pull money from the US banking system until the banks offer competitive rates that match at least the Fed funds rate.

The next question is, if the US Treasury is selling debt, what type of debt would the public like to buy (if any)? That’s an easy question to answer as well.

Everyone is feeling the effects of inflation, and therefore has a very high liquidity preference. Everyone wants access to their money immediately because they don’t know the future path of inflation, and given that inflation is already high, they want to buy things now before they get more expensive in the future. If the US Treasury offered you a 1-year bill at a yield of 5% or a 30-year bond at a yield of 3% because the yield curve is inverted, what would you prefer?

Ding ding ding – you want the 1-year bill . Not only do you get a higher yield, you get your money repaid faster, and you have 1-year inflation risk vs. 30-year inflation risk. The US private sector prefers short-term USTs. They will express this preference by purchasing money market funds and exchange traded funds (ETF) that can only hold short-term debt.

Note*: an inverted yield curve means long-term yields less than short-term debt. Naturally, you would expect to receive more income to lend money for a longer period of time. But inverted yield curves are not natural and point to severe dysfunction in the economy.*

The US Federal Government

I touched on this above, but indulge me as I expand on the same theme in a more colorful and illustrative manner.

Imagine there are two politicians.

Oprah Winfrey wants everyone to be happy and live their best lives. She campaigns on a platform of ensuring that everyone has food on the table, a car in the garage with a full gas tank, and the best possible medical care, all the way up until they expire. She also says she won’t raise taxes to pay for this. How will she pay for all these goodies? She’ll borrow money from the rest of the world to do it, and she believes it can be done because the US is the global reserve currency issuer.

Scrooge McDuck is a miser and hates debt. He will give little to no government benefits because he doesn’t want to raise taxes and doesn’t want to borrow money to pay for things the government cannot afford. If you have a job that allows you to afford a full fridge, a pick-up truck, and top notch medical care, that’s your business. But if you can’t afford those things, that’s your business as well. He doesn’t believe it’s the government’s job to provide them for you. He wants to preserve the value of the dollar and make sure there is no reason for investors to hold anything else.

This is a photo of US Treasury Secretary Andrew Mellon, aka Scrooge, who famously said during the great depression, “Liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people.” As you can imagine, that message was not well received.

Imagine you are in the late stages of an empire where income inequality has skyrocketed. In a “one human, one vote” democratic republic, where mathematically, the majority of the population is always below average in terms of income, who wins? Oprah wins every single time. Free shit paid for by someone else via the use of a money printer always wins.

The number one job of a politician is to get re-elected. Therefore, regardless of which political party they belong to, they will always prioritize spending money they don’t have in order to garner the support of the majority of the population.

Absent a serious rebuke from the long-term debt markets or hyperinflation, there is no reason not to run on a “free shit” platform. Which means that, moving forward, I don’t expect to see any material change in the spending habits of the US Federal Government. As it pertains to this analysis, trillions of dollars will continue being borrowed every year to pay for goodies.

The US Banking System

Simply put, the US banking system – and all other major banking systems – are fucked. I will quickly recap why.

Due to the COVID stimulus provided by governments globally, assets in the banking system ballooned. Banks followed the rules and lent these deposits to governments and businesses at very low rates. That worked for a while because banks paid 0% on deposits but earned 2% to 3% lending to others on a longer-term basis. But then, inflation showed up and all major central banks – the Fed being the most aggressive – raised short-term policy rates well above what government bonds, mortgages, business loans, etc. yielded in 2020 and 2021. Depositors could now earn vastly higher amounts of money buying money market funds that invested in the Fed’s RRP or in short-term USTs. Therefore, depositors started pulling money out of the banks to earn a better yield. The banks could not compete with the government because it would destroy their profitability – imagine a bank with a loan book that yields 3% but pays 5% on deposits. At some point, that bank will go bust. Therefore, bank stockholders started dumping shares in banks because they realized those banks mathematically cannot earn a profit. This has led to a self-fulfilling prophecy in which a number of banks’ solvency has been called into question due to their rapidly falling stock prices.

In my recent interview at Bitcoin Miami with Zoltan Pozar, I asked him what he thought of the US banking system. He replied that the system was ultimately sound and it was just a few bad apples. This is the same message trumped by various Fed governors and US Treasury Secretary Janet Yellen. I vehemently disagree.

The banking system will ultimately always be bailed out by the government. However, if systemic problems facing the banks are not addressed, they will be unable to fulfil one of their most crucial functions: channeling the savings of the nation to long-term government bonds.

Banks now face two choices:

Option 1: Sell assets (USTs, mortgages, car loans, commercial real estate loans, etc.) at a massive loss and then raise deposit rates to attract customers back to the bank.

This option recognizes the implicit loss on the balance sheet, but guarantees the bank cannot be profitable on an ongoing basis. The yield curve is inverted, which means the bank will pay a high short-term interest rate on deposits without being able to lend those deposits out longer term at a higher rate.

US Treasury 10-year Yield Minus 2-year Yield

The banks cannot purchase long-term government bonds because it will lock in a loss – VERY IMPORTANT!

The only thing banks can buy is short-term government bonds or park their money with the Fed (IORB) and earn slightly more than they pay out as deposits. The banks will be lucky to generate 0.5% of Net Interest Margin (NIM) following this strategy.

Option 2: Do nothing, and when depositors flee, swap your assets with the Fed for freshly printed dollars.

This is essentially what the Bank Term Funding Program (BTFP) is. I talked about this in great detail in my essay “Kaiseki”. Forget about whether what the bank holds on its balance sheet is eligible collateral for the BTFP – the real problem is that the bank cannot grow its deposit base and then take those deposits and buy long-term government bonds.

The US Treasury

I know the media and markets are focused on when the US debt ceiling will be hit and whether the two political parties will find a compromise to raise it. Ignore this circus – the debt ceiling will be raised (as it always is, given the much bleaker alternative). And when it is, sometime this summer, the US Treasury has some work to do.

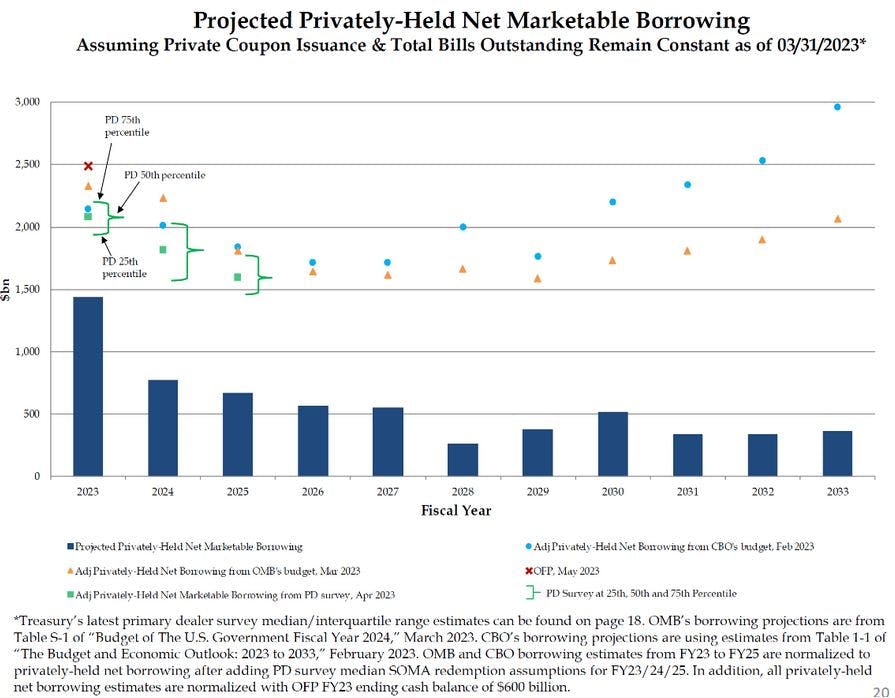

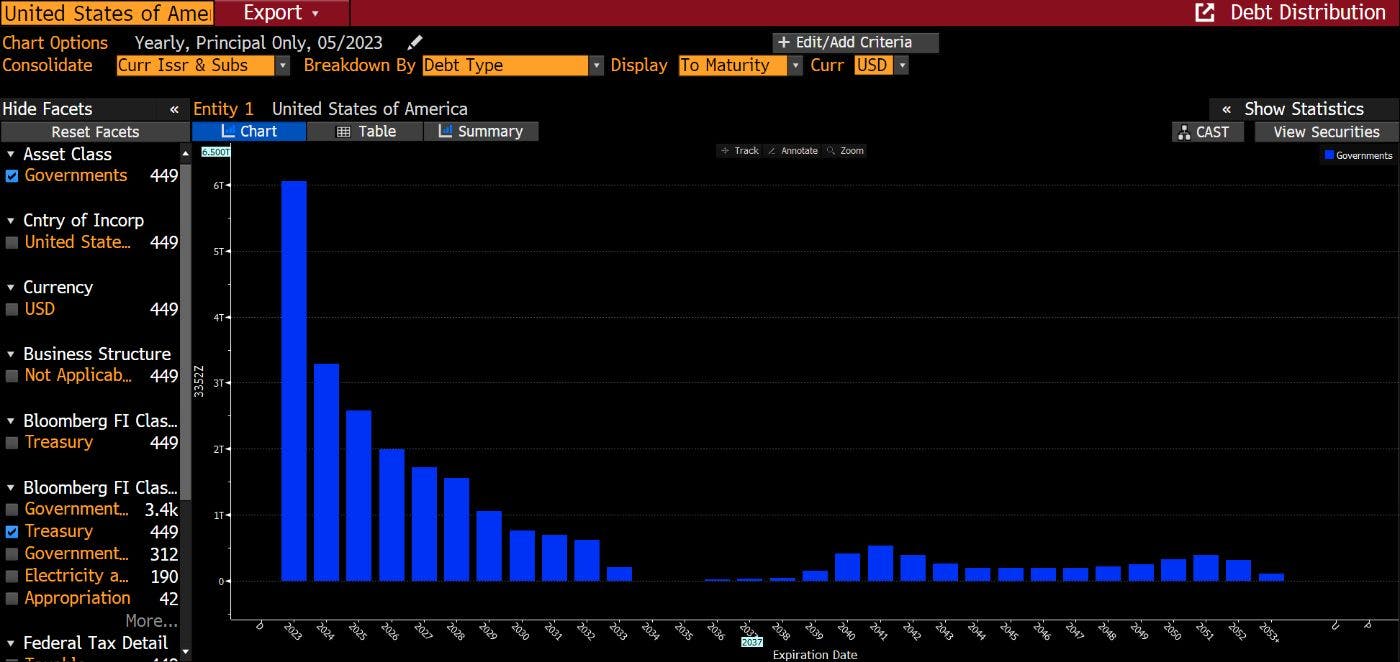

The US Treasury must issue trillions of dollars worth of debt to fund the government. The important thing to focus on is what the maturity profile of the debt sold is. Obviously it would be great if the US Treasury could sell trillions of dollars worth of 30-year bonds, because those bonds yield almost 2% less than <1-year maturing bills. But can the market handle that? Nope nope nope!

Source: TBAC

Maturity Profile of US Treasury Debt

Between now and the end of 2024, ~$9.3 trillion of debt must be rolled over. As you can see, the US Treasury has been unwilling or unable to issue the lion’s share of debt at the long-end, and has instead been funding at the short-end. Rut-roh! This is bad news bears because rates at the short end are higher than rates at the long end, which increases the interest expense.

Here we go.

Here is a table of the major potential buyers of US Treasury bills, notes, and bonds:

| Potential Buyer | Will They Buy | Maturity Preference |

|---|---|---|

| Foreigners | No | N/A |

| Private Sector | Yes | Short-term |

| Banking Sector | Yes | Short-term |

None of the major buyers want to or are able to purchase long-term USTs. Therefore, if the US Treasury tried to stuff the market with trillions of dollars worth of long-term debt, the market would demand a vastly higher yield. Imagine if the 30-year yield doubled from 3.5% to 7% – it would crater bond prices and mark the end of many financial institutions. That is because those financial institutions were encouraged by regulators to load up on long-term debt using almost infinite amounts of leverage. Y’all crypto folks know what that means: REKT!

US Treasury Actives Yield Curve

Janet Yellen is no fool. She and her advisers know it is impossible to issue the debt they need at the long end of the yield curve. Therefore, they will issue debt to where the demand is off the charts: the short end of the yield curve. Everyone wants to earn high short-term rates, which will probably be going even higher as inflation kicks back into gear later this year.

As the US Treasury sells $1 to $2 trillion of debt, yields will rise at the short end. This will further exacerbate the bank system problems, because depositors get a better deal lending to the government than to the bank. This in turn guarantees the banks cannot be profitable with negative NIM on newly issued loans, and therefore cannot support the government by buying long-term bonds. The circle of death is fast approaching.

The Fed

And now for the finale. Sir Powell has quite a mess on his hands. Every constituent is pulling his central bank in a different direction.

Cut Rates

The Fed controls/manipulates short-term interest rates by setting the rate on the RRP and IORB. Money market funds can earn a yield in the RRP, and banks can earn a yield in the IORB. Without these two facilities, the Fed is powerless to paint the tape where it wants.

The Fed could cut the interest rates of both facilities aggressively, which would immediately steepen the yield curve. The benefits would be:

- The banks become profitable again. They can compete with the rates offered by money market funds, rebuild their deposit base, and start lending long again to businesses and the government. The US banking crisis ends. The US economy goes gangbusters as err’body gets cheap credit again.

- The US Treasury can issue more debt with longer maturities because the yield curve is positively sloped. Short-end rates would fall but long-end rates would remain unchanged. This is desirable because it means the interest expense on the long-term debt is unchanged, but the attractiveness of that debt as an investment increases.

The downside is that inflation would accelerate. The price of money would fall, and the things the electorate cares about – like food and fuel – would continue rising in price faster than wages.

Raise Rates

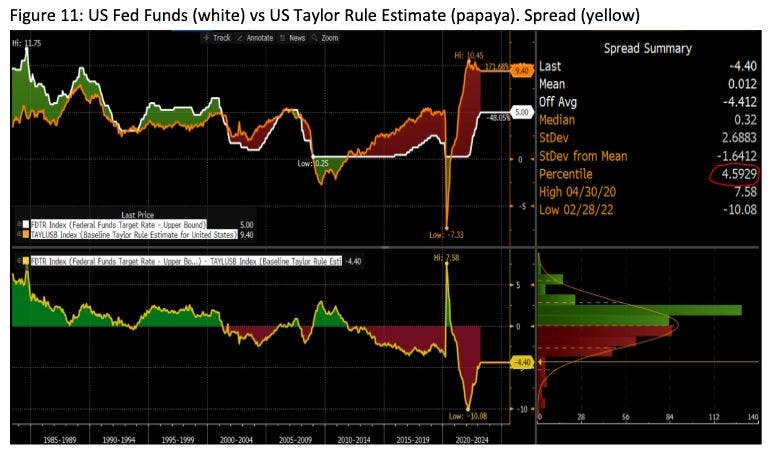

If Powell wants to keep fighting inflation, he must continue to hike rates. For you economic wonks, using the Taylor rule, the US rates are still deeply negative.

Here are the negative consequences of continuing of raise rates:

- The private sector continues to prefer lending to the Fed via money market funds and the RPP vs. depositing money at the bank. US banks continue going bankrupt and getting bailed out due to a falling deposit base. The Fed’s balance sheet might not be warehousing the mess, but the Federal Deposit and Insurance Corporation (FDIC) is now chock-full of dogshit loans. Ultimately, this is still inflationary, as depositors get paid back in full with printed money, and they get to earn more and more interest income lending to the government rather than to the bank.

- The yield curve inversion continues, which removes the ability for the US Treasury to issue long-term debt in the size it needs.

I want to expand a bit more on the notion that raising rates is also inflationary. I subscribe to the point of view that the quantity of money is more important than the price of money. I am focused here on the quantity of USD injected into the global markets.

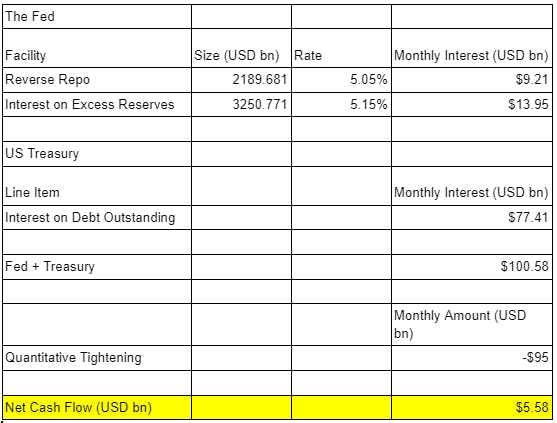

As rates go higher, there are three buckets in which global investors are receiving income in the form of printed USDs. The printed money comes either from the Fed or the US Treasury. The Fed prints money and hands it out as interest to those invested in the Reverse Repo facility or to banks who hold reserves with the Fed. Remember – if the Fed wishes to continue manipulating short-term rates, it must have these facilities.

The US Treasury pays out interest to debt holders in greater sums if it issues more debt and/or if interest rates on newly issued debt rises. Both of these things are happening.

Combined, the interest paid out by the Fed via the RRP and IORB and the interest paid on US Treasury debt is simulative. But isn’t the Fed supposed to be reducing the quantity of money and credit via its quantitative tightening (QT) program? Yes, that’s correct – but now, let’s analyze what the net effect is and how it will evolve in the future.

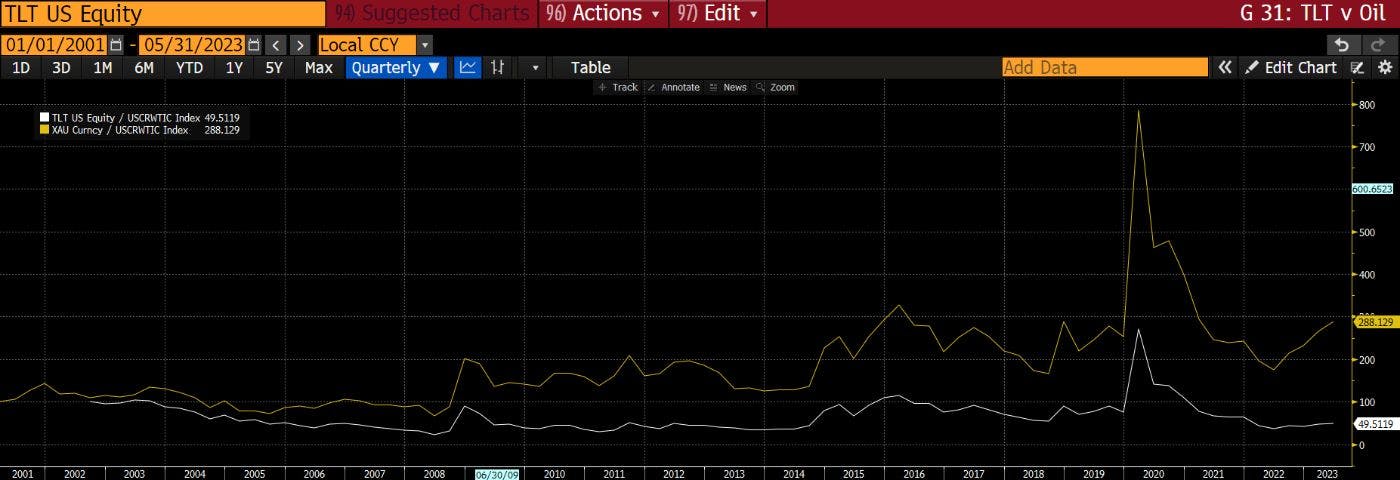

Source: St. Louis Fed

As we can see, the effect of QT has been completely nullified by interest paid out via other means. The quantity of money is expanding even as the Fed shrinks its balance sheet and raises rates. But will this continue in the future, and if so, in what magnitude? Here’s my thinking:

- The private sector and US banks prefer parking money at the Fed, and therefore RRP and IORB balances will grow.

- If the Fed wants to raise rates, it must raise the rate it pays on money parked in the RRP and IORB.

- The US Treasury will soon need to finance $1 to $2 trillion deficits into the foreseeable future, and it must do so at higher and rising short-term rates. Given the maturity profile of the total US debt stock, we know that actual money interest expense can only mathematically rise.

Taking those three things together, we know that the net effect of US monetary policy is currently simulative and the money printer is churning out more and more fiat toilet paper. And remember, this happens because the Fed is raising rates to fight inflation. But if raising interest rates is actually increasing the money supply, then it follows that raising interest rates actually increases inflation. MIND FUCKING BLOWN!

Of course, the Fed could increase the pace of QT to offset these effects, but that would require the Fed to at some point become an outright seller of USTs and MBS, on top of foreigners and the banking system. If the largest holder of debt is also selling (the Fed), UST market dysfunction will rise. This would spook investors and long-end yields would spike as everyone rushes to sell what they can before the Fed does the same. And then the jig is up, and we see what the emperor is workin’ wit. And we know it’s a teenie weenie.

Let’s Trade This

To read my thoughts on how I will be trading this, please visit my Substack. There is no cost to becoming a subscriber.

If you are a believer of the one true Lord Satoshi, time is on your side. If you throw your lot in with the TradFi devil, tick tock…

Between now and the autumn harvest, a few important things will happen.

First, the US debt ceiling will be raised this summer. That allows the US Treasury to begin issuing debt to fund the government. As the US Treasury rolls maturing debt and issues new debt, the net effect will be more debt outstanding yielding higher interest rates. The issuance of debt could become a temporary drain on USD liquidity as the Treasury’s General Account (TGA) rises. But over time, the Treasury spends money, the TGA declines, and USD liquidity increases.

Second, as I laid out above, inflation will bottom and start slowly ticking higher. That means the Fed might pause its rate hikes in June, only to reignite the fire by raising rates at their July meeting. By the time the Jackson Hole central banker jamboree occurs in late August, policy rates might be close to 6%. Higher rates would increase the amount of money paid out in interest on RRP and IORB balances.

Finally, depositors will continue to move money from non-Too Big To Fail (TBTF) banks to TBTF banks, and/or into money market funds. Money market funds will park money in the RRP, and TBTF banks will park money in the IORB. In both circumstances, RRP and or IORB balances grow. TBTF banks are flush with cash, and that’s why they pay little to no interest on deposits and take any additional money received and park it with the Fed (hence the rise in IORB). This increases the amount of money that is printed by the Fed to pay interest to money parked in these facilities.

Adding it all up, the daily amount of USD liquidity injected into the system will continue to grow. The rate of change of USD liquidity injections will also accelerate because the larger the balances grow, the more interest is paid. Compound interest is a geometric progression.

Bitcoin experienced a roughly 10% drawdown from the April highs. All of this interest paid is effectively a stimulus program to wealthy asset holders. What do wealthy asset holders do when they have more money than they need? They purchase risk assets. Gold, Bitcoin, AI tech stocks, etc. will all be beneficiaries of this “wealth” that is printed by the government and handed out as interest.

I expect that Bitcoin will hold firm here. I do not believe we will retest $20,000 or come anywhere close. As money slowly trickles into the global risk asset markets, a strong base of support will form. Volatility and trading volumes always disappoint during the northern hemispheric summer months, so I am not surprised that degens plagued by boredom have checked out of crypto trading for the time being. I will use this time of calm to slowly increase my allocation to Bitcoin after the TGA is replenished.

As more and more pundits start talking about what is happening to the billions of dollars printed by the Fed and US Treasury and handed out as interest, it will become common knowledge once more that the money printer is going brrr. And when the printer goes brrr, Bitcoin goes boom!

This article was originally published by Arthur Hayes on Hackernoon.