Big tech companies like Google and Facebook are under investigation for antitrust by the the FTC and the DOJ. The allegations are that these companies engage in anti-competitive behavior.

Competition creates winners and losers. Those who compete, compete to win, and annihilating the competition has worked well for big tech — so much so — that it is accused of antritust violations.

But what’s wrong with winning? Why punish a company for being successful by stamping out competition? Isn’t that the whole point — to dominate your market?

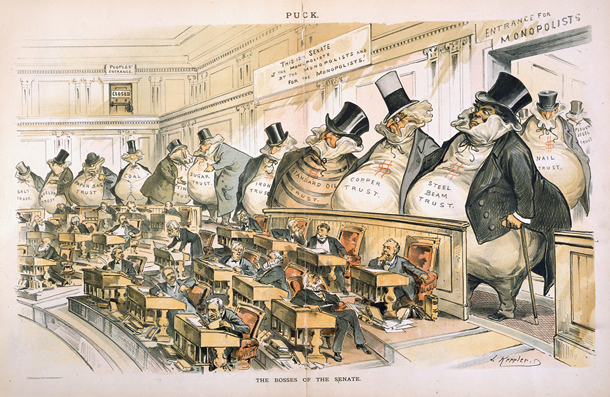

Cartoon: Google Antitrust https://t.co/lHhPpL970G pic.twitter.com/j1HTUDRdvk

— Henry Payne (@HenryEPayne) September 12, 2019

Contrary to popular belief, monopolies are legal in the United States. A company can rise above the competition when it offers superior goods or services that nobody else can provide.

“It is not illegal for a company to have a monopoly, to charge ‘high prices,’ or to try to achieve a monopoly position by aggressive methods,” according to the FTC.

However, there is a Catch-22.

“A company violates the law only if it tries to maintain or acquire a monopoly through unreasonable methods.”

That means a company can legally have a monopoly, but it can’t legally maintain or acquire one through “unreasonable methods,” so what are those methods?

Determining the difference between anti-competitive behavior and just smart business practice is a slippery slope.

“You can’t look at Standard Oil without looking at oil; you cannot investigate Google without looking at search” — Luther Lowe

In antitrust cases, it is important to look at what is being protected — competition itself or the losing competitors who cry anti-competition.

Equally as important is the general public — what businesses call the consumer. How can anti-competitive behavior on the part of a big tech company negatively affect the consumer?

These questions are at the heart of the antitrust investigations into big tech. What constitutes “unreasonable methods,” what parties are ultimately affected, and how?

When the consumer is negatively affected by anti-competitive behavior, or when all competition is either threatened, bought-out, acquired, or merged, the company is treading on antritust.

When a company acts tyrannical in denying the entry of a competing company into the market space, it begins to wade into anti-competitive waters.

Likewise, when a company self-serves by blocking competition while favoring its own products and services, which may or not be inferior to the competition, it is traversing in antitrust territory.

When illegal, anti-competitive practices are in place. the consumer gets screwed from a lack of options, the competition complains, and innovation is stifled.

Luther Lowe

“Google, in particular, has biased its results to serve its interests and leverage its power to entrench it further and hurt consumers in the process” — Luther Lowe

The antitrust accusations against big tech have far-reaching implications on society at large because its greatest commodity is data.

By owning and controlling data on billions of people, big tech knows more about you and I than we know about ourselves.

This gives big tech incredible power and influence to sway public opinion with barely any accountability. It does so by controlling the data and controlling what information you and I can access.

What better place to control which information people can access than by online search?

“You can’t look at Standard Oil without looking at oil; you cannot investigate Google without looking at search,” testified Luther Lowe, Senior Vice President of Public Policy at Yelp, during a hearing before the Senate Subcommittee on Antitrust, Competition Policy and Consumer Rights on Tuesday.

“For years, Google, in particular, has biased its results to serve its interests and leverage its power to entrench it further and hurt consumers in the process,” he added.

If Google were slapped with an antitrust lawsuit, would the ruling protect competition itself or the competitor — Yelp? Perhaps none; perhaps both.

But, how do big tech companies like Google, Facebook, Apple, and Amazon allegedly leverage their power?

According to testimony by Sally Hubbard, Director of Enforcement Strategy at the Open Markets Institute, tech giants buy-up all the competition, which she believes is illegal and in violation of the Clayton Act.

Sally Hubbard

“I believe that each platform is illegally monopolizing” — Sally Hubbard

“Together, Facebook and Google have bought more than 150 companies since 2013. Google alone has acquired nearly 250 companies since 2006. At last count, Apple has bought more than 100 companies and Amazon nearly 90.

“Many of these acquisitions were illegal under the Clayton Act’s prohibition of mergers and acquisitions where the effect may be substantially to lessen competition, or to tend to create a monopoly,” Hubbard testified.

Alleged illegal mergers in violation of the Clayton Act are on one side of the coin, but Hubbard argued that illegal monopolization in violation of the Sherman Act is on the other side.

“The platform monopolists of the 21st century have long followed the monopolist’s classic playbook, in which they exploit their positions as providers of multiple essential services to bankrupt, supplant, or sideline rivals in every market in which they operate,” Hubbard testified.

“Because Google, Amazon, Facebook, and Apple each have monopoly power and engage in exclusionary conduct to acquire or maintain that power, I believe that each platform is illegally monopolizing in violation of Section 2 of the Sherman Act,” she added.

“When digital platforms pick the winners and losers of our economy, we lose the American promise of upward mobility based on merit. Increasingly, the platforms exploit their middleman positions to pick themselves as the winners of our economy.”

“Knowledge, like wealth, is intended for Use” — The Kybalion

Anti-competitive behavior on the part of big tech — with its dominance over the flow of information through search, news, and social media — creates an un-elected technocracy.

A population cannot make informed decisions when all the information is controlled by a few companies in Silicon Valley — nearly all of which were funded by the government through DARPA or the National Science Foundation.

The rhythm of the pendulum; however, is always in motion. It gathers momentum and swings one way, only to reach its apex, and return to where it started.

The startups of today are competing to become the monopolies of tomorrow.

The monopolies of today will one day be reduced to their beginnings.

Such is the nature of time, and such is the nature of all journeys.

Know yourself before big tech owns your beliefs and directs your decisions: Op-ed