The Illinois Department of Public Health (IDPH) is using alternative credit data expert Experian to confirm users’ identities on the newly launched Vax Verify portal.

“IDPH cannot guarantee that the recipient will not re-disclose the immunization information provided to a third party” — Illinois Department of Public Health’s Consent for Third Party Access

The Vax Verify portal allows Illinois residents to download and print copies of their vaccination records, which can then be used to gain entry to establishments and venues that require them.

According to Patch, officials are adamant that Vax Verify “is not a vaccine passport;” however, the Vax Verify portal “will aid residents in confirming their vaccination where needed,” as IDPH Director Dr. Ngozi Ezike explains in a press release.

Dr. Ngozi Ezike

“This new tool will aid residents in confirming their vaccination where needed” — Dr. Ngozi Ezike, Director of Illinois Department of Public Health

“As more businesses, events, organizations, and others require proof of vaccination, Illinois residents will be able to confirm using Vax Verify that they have been vaccinated for COVID19,” said Dr. Ngozi.

“With the current surge in cases, more people are making the decision to get a COVID-19 vaccine, and this new tool will aid residents in confirming their vaccination where needed,” she added.

In order to use the Vax Verify portal, Illinois residents will have to go through the world’s largest credit bureau, Experian, which the State of Illinois has chosen to be its identity proofing service provider.

Why use a credit reporting company?

Why is Experian, a global credit reporting company, working with a state government on a proof of vaccination portal?

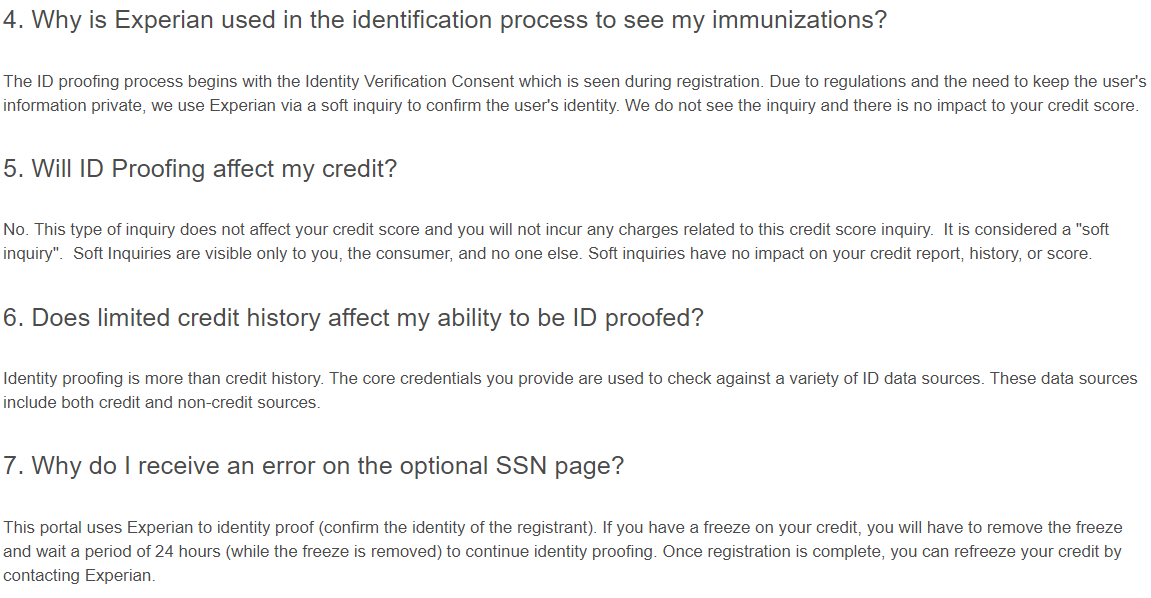

The official answer, according to the Vax Verify FAQ page, is that, “Due to regulations and the need to keep the user’s information private, we use Experian via a soft inquiry to confirm the user’s identity.”

“The core credentials you provide are used to check against a variety of ID data sources. These data sources include both credit and non-credit sources” — Vax Verify FAQ

The Illinois Department of Public Health could have selected any given identity proofing company for its portal, but it decided to go with Experian — a company with expertise in alternative credit data sources and solutions.

Why?

According to the Vax Verify FAQ, “Identity proofing is more than credit history. The core credentials you provide are used to check against a variety of ID data sources. These data sources include both credit and non-credit sources.”

With Experian as its partner, the IDPH’s Vax Verify system will sift through a variety of both credit and non-credit ID data sources.

The optics of a credit bureau partnering with a state government on a proof of vaccination portal may raise questions about whether a person’s vaccination status will have anything to do with their credit score.

However, the IDPH assures on its Vax Verify FAQ page, “there is no impact to your credit score.”

Will that always be the case, or can the rules be changed at any given moment for any given reason?

Alternative credit scoring pulls data from telecommunications companies

Who will benefit most from the Vax Verify portal?

What type of data is being collected and for what purposes?

“This thing, what is it in itself, in its own constitution? What is its substance and material? What is its causal nature (or form)? What is it doing in the world? And how long does it subsist?” — Marcus Aurelius, Meditations

What is Experian in itself? What is its nature? What is it doing in the world?

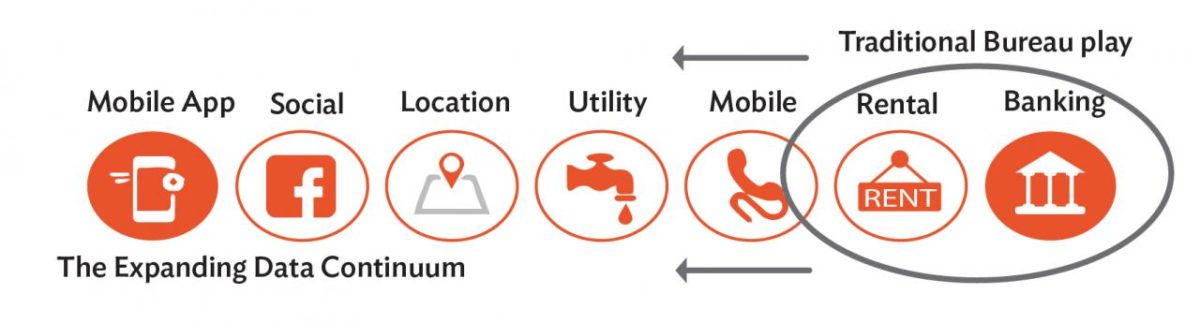

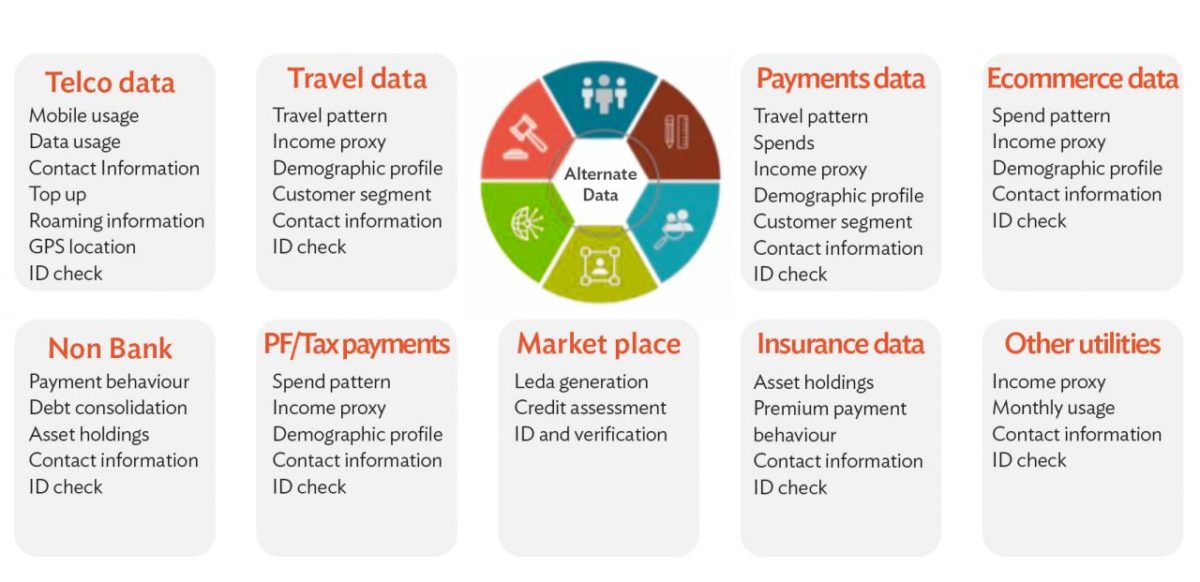

Experian is a global leader in credit reporting and marketing solutions, and the company is an expert in alternative credit data solutions, which rely heavily on telecommunications companies for that data.

With “telco data,” lenders can make accurate inferences and predictions about a potential client’s socioeconomic activity.

“Telco usage is a great indicator of the user’s economic activity and lifestyle” — FinScore

In March, 2021, Experian partnered with Filipino fintech FinScore on a “new-to-market telco scoring product, Experian PowerScore.”

According to FinScore, “Telcos trace information related to call duration, call origin location, call destinations, porting history, duration of SIM ownership, handsets used, number of missed calls, and other types of data.

“When all of these factors are analyzed, they’re clumped into a single category called telco data.”

Now, the newly-launched Experian PowerScore is analyzing telco data that is “based on over 400 telco variables.”

“Telco Data is notably the alternative data that is considered to have the most predictive power for measuring creditworthiness in the absence of credit history that is common to unbanked Filipinos” — FinScore

By combining Experian’s expertise with FinScore’s telco data scoring, lenders can gain intimate insights into individuals, including:

- Data and voice usage

- Top-up patterns

- Geolocation

- SIM age

- And much more

Additionally, “Telco Data is notably the alternative data that is considered to have the most predictive power for measuring creditworthiness in the absence of credit history that is common to unbanked Filipinos,” according to FinScore.

And according to PwC, “Data from online social networks, mobile phone records and psychometrics [scores based on personality and behavior] are parameters that are currently being used to evaluate the potential of borrowers.”

“A consumer’s digital footprint is often difficult to manipulate and may offer a more comprehensive view of a consumer’s socioeconomic activity” — FinScore

Image Source: FinScore

As Experian expands alternative credit scoring in the Philippines, the Illinois Department of Public Health assures that “there is no impact to your credit score” when you sign up for the Vax Verify portal.

But looking further down the road, could there ever be a time when a person’s vaccination status impacts their credit score?

What will become of all the data?

Last year, the South African Banking Risk Information Centre reported that Experian “experienced a breach of data which has exposed some personal information of as many as 24 million South Africans and 793,749 business entities to a suspected fraudster.”

Vax Verify data ‘may be subject to re-disclosure’ by third parties

Those registering on the Vax Verify portal are asked to agree to Experian’s Terms of Service, which authorizes “the State of Illinois to obtain information from your personal credit profile or other information from Experian.”

That’s one avenue of the data flow: Experian —> State of Illinois.

Another is the IDPH’s Consent for Third Party Access form, which states:

- “The information disclosed pursuant to this authorization may be subject to re-disclosure by the recipient and may no longer be protected by applicable federal or Illinois law.”

- “IDPH cannot guarantee that the recipient will not re-disclose the immunization information provided to a third party. The third party may not be required to abide by this authorization or applicable federal or Illinois law governing the use and disclosure of health information.”

Here we see the data flowing from Experian —> State of Illinois —> Third Parties —> ?

What it boils down to basically, is that if Illinois residents consent to Vax Verify’s third party access, their data could end up just about anywhere, including their vaccination status, with no guarantees from the Illinois Department of Public Health regarding where that data will ultimately end up.

Will Vax Verify primarily benefit the citizens of Illinois, or will it give both the government and Experian more behavioral data to potentially analyze, sell, or otherwise exploit?

Who benefits the most?

Vaccine passports lay the foundation for digital identity, social credit systems

Rules change. Emergency powers expand.

Public and private collaborations are pushing society closer to a social credit system where fundamental human rights are pushed aside for those without proof of vaccination, despite the fact that the some people have underlying health issues that prevent them from taking the shots, which haven’t been proven to prevent transmission, while the concepts of natural immunity and bodily integrity are almost completely ignored by authoritative bodies.

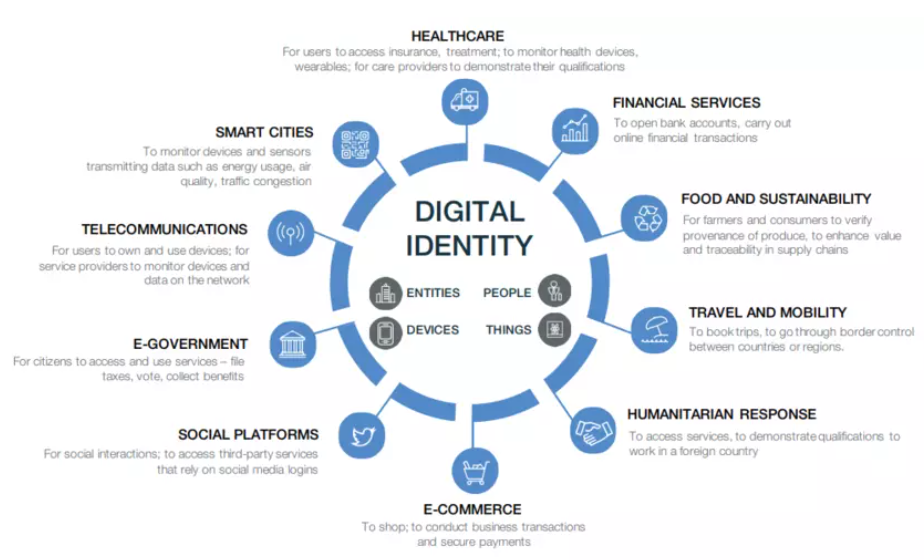

Vaccine passports are a stepping stone to digital identity schemes where access to goods and services is highjacked based on an individual’s level of compliance to ever-changing rules and mandates.

Image Source: World Economic Forum

Meanwhile, companies that specialize in credit reporting and payments, like Experian and Mastercard, are working with the public and private sectors on digital health passes and portals.

Why?

Why are credit companies working with governments on vaccine passport and digital health pass rollouts?

Could this merger of corporation and state be laying the foundations for a future social credit system?

Welcome to the great reset

When you consider the World Economic Forum’s great reset agenda where “you’ll own nothing, have no privacy, and you’ll be happy,” what will be the proposed currency of the future?

Will it be based on wages earned from labor, or will the currency of the future be based on your behavior — your social credit score?

The term “fully vaccinated” has become a moving target, and booster shots are on the horizon with no end in sight.

In several countries, you must show proof of vaccination to participate in many aspects of society, but citizens all over the world are rising up against the increasing medical tyranny and Orwellian government mandates.

If left unchecked, these extraordinary emergency powers may become permanent fixtures that can be expanded to suit any agenda.

Think fully traceable and permissions-based Central Bank Digital Currencies that limit what you can buy, how much, and from where.

Think climate lockdowns, restrictions on mobility, forcing small businesses to become agents of a government agenda, and a society of snitches where neighbors turn each other in to the authorities for not complying with the draconian mandates.

Many countries are heading in the direction of complete control over the whole of society.

Freedom is what’s ultimately at stake in this abhorrent new normal championed by powerful global interests that hope vaccine passports will drive a forced consensus on digital identity schemes that can easily morph into social crediting tools in the very near future.

COVID passport mandates are fueling authoritarian social credit systems, digital identity schemes

Citizens all over the world are rising up against vaccine passports, lockdowns

Your digital identity can be used against you in the event of a great reset

A timeline of the great reset agenda: from foundation to Event 201 and the pandemic of 2020