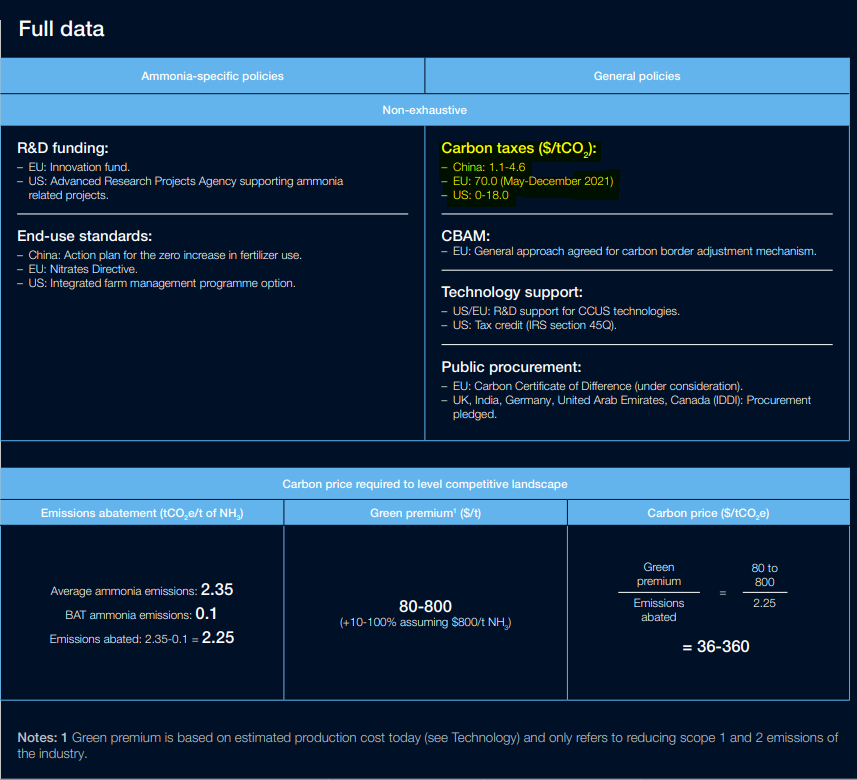

The unelected globalists at the World Economic Forum (WEF) publish a report proposing specific carbon prices across six major industries: steel, cement, aluminum, ammonia, oil, and natural gas.

Using data from the World Bank, Accenture, and other organizations, the WEF’s NetZero Industry Tracker 2022 report gives a price per ton (t) on carbon dioxide (CO2) and CO2 equivalent (CO2e) for the following industries:

- Steel: $180 – $360 / tCO2e

- Cement: $60 – $110 / tCO2e

- Aluminum: $210 / tCO2

- Ammonia: $36 – $360 / tCO2e

- Oil: $247 / tCO2e

- Natural Gas: $20 – $30 / tCO2e

From the vehicles that transport people and goods on land, air, and sea to the construction of homes, offices, and apartment buildings; from the fertilizer that feeds the world’s populations to the energy sources that have provided humanity with a greater quality of life — all are to be found among the six industries that the unelected globalists wish to “incentivize” in the name of net zero policies.

“There is a global price on carbon” — WEF, 8 Predictions for the World in 2030, 2016

With a desire to drastically cut carbon emissions by 2030, the unelected globalists are looking to “incentivize” industries to “go green.”

In its “8 predictions for the World in 2030,” the WEF predicted in 2016 that there would be a global price on carbon.

Now, it appears the unelected globalists are making good on that prediction with their carbon pricing policy proposals.

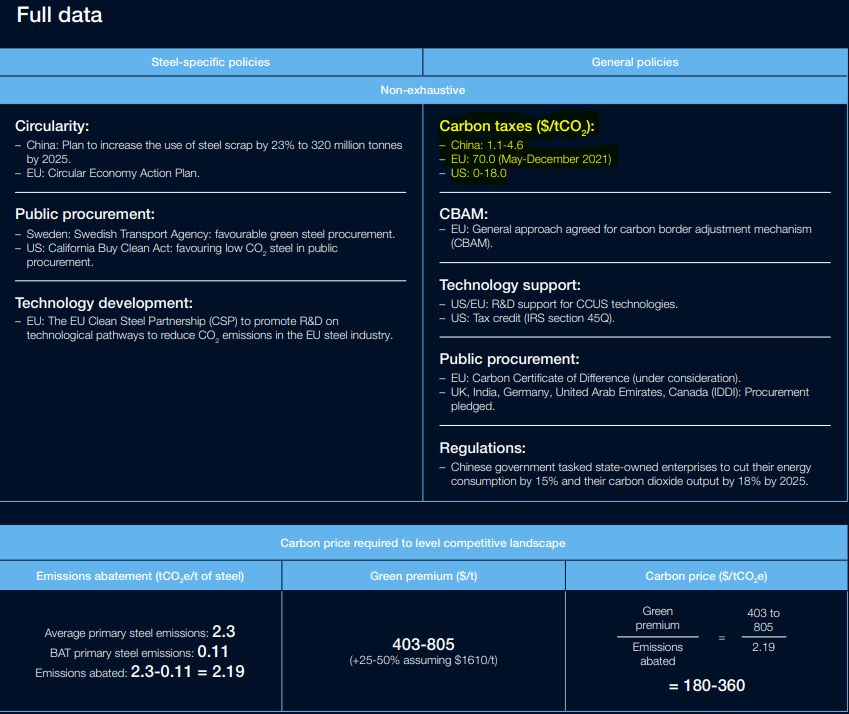

Carbon Price on Steel Proposal

When it comes to the steel industry, the unelected globalists lament, “Current carbon prices are too low to incentivize a rapid growth of a low-emission industry.”

Therefore, “an equivalent carbon price of $180-360/tCO2e needs to be added to high emission products.”

“An equivalent carbon price of $180-360/tCO2e needs to be added to high emission products” — WEF NetZero Industry Tracker 2022, Steel

“To boost demand signals, building steel buyers’ confidence in their ability to pass their 25-50% green premium to end consumers is essential” — WEF NetZero Industry Tracker 2022, Steel

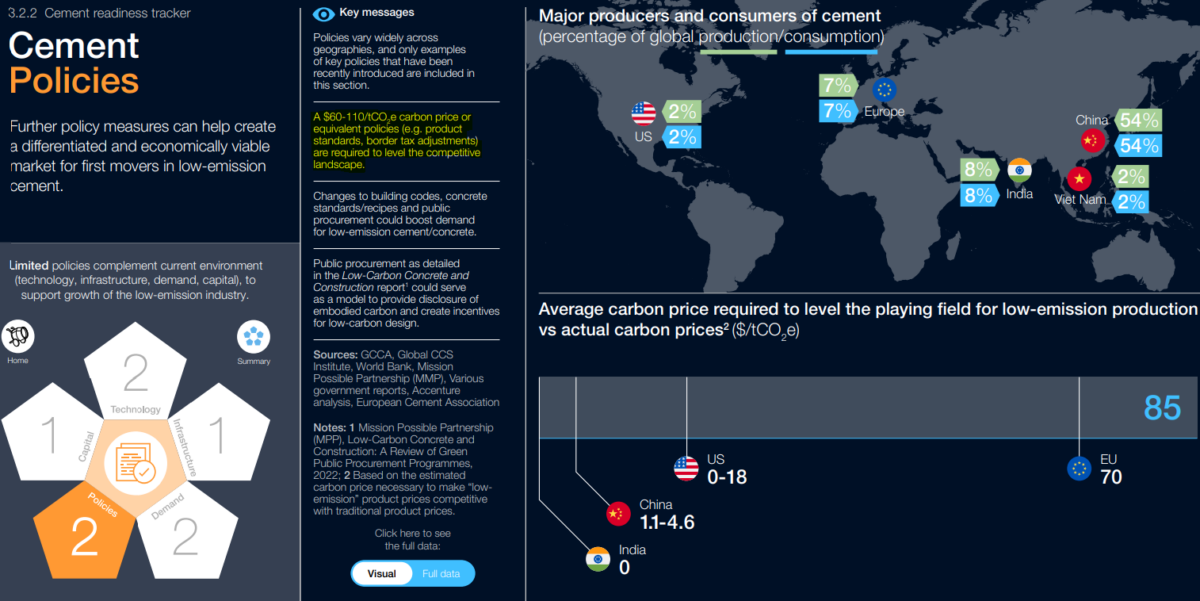

Carbon Price on Cement Proposal

“Cement is the second most consumed material in the world after water, with no scalable substitutes today,” the report says, adding, “More than 50% is made in China.”

“A $60-110/tCO2e carbon price or equivalent policies (e.g. product standards, border tax adjustments) are required to level the competitive landscape” — WEF NetZero Industry Tracker 2022, Cement

With cement being crucial to construction, the unelected globalists want to put a price on cement carbon emissions as well.

Therefore, “A $60-110/tCO2e carbon price or equivalent policies (e.g. product standards, border tax adjustments) are required to level the competitive landscape.”

“To incentivize investments, building cement buyers’ confidence in their ability to pass their 50%+ green premium to end consumers is essential” — WEF NetZero Industry Tracker 2022, Cement

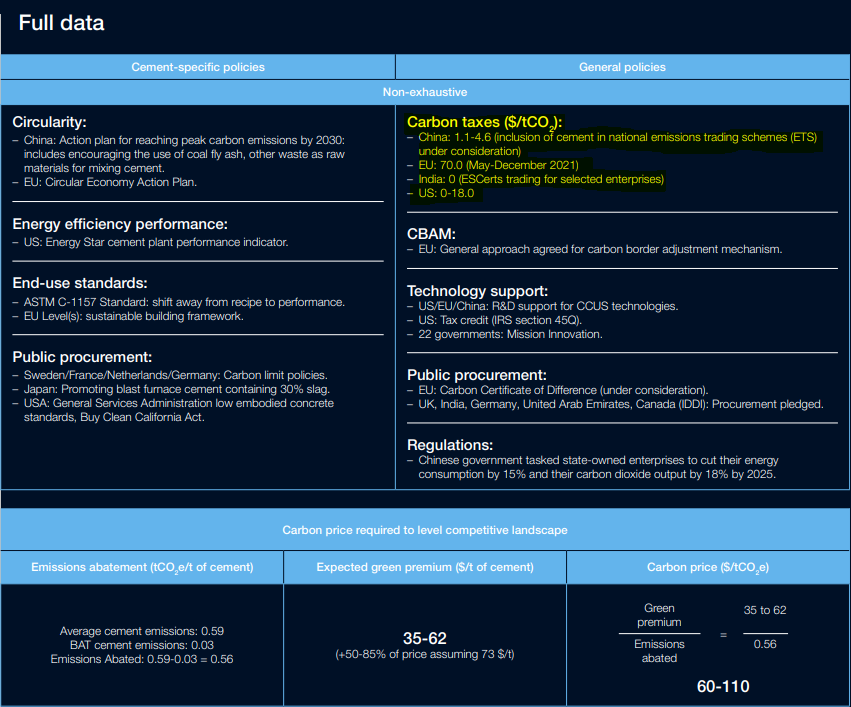

Carbon Price on Aluminum Proposal

Another highly-used building material industry that the unelected globalists want to incentivize for their net zero agenda is aluminum.

“A carbon price of $210/t of CO2 is required to incentivize the use of CCUS in smelting” — WEF NetZero Industry Tracker 2022, Aluminum

According to the report, “There is no low-emission aluminum in line with IEA [International Energy Agency] Net Zero by 2050 Scenario available today.”

The unelected globalists suggest, “A carbon price of $210/t of CO2 is required to incentivize the use of CCUS [Carbon Capture, Utilization & Storage] in smelting.

The price of $210/t of CO2 “is significantly higher than the current carbon prices in major consuming countries.”

However, “This could be achieved through pricing policies or nonpricing policies such as product standards, public procurement standards or carbon border tax adjustments which will require international cooperation.”

“Building aluminum buyers’ confidence in their ability to pass their 38% green premium to end consumers is essential to boost demand signals” — WEF NetZero Industry Tracker 2022, Aluminum

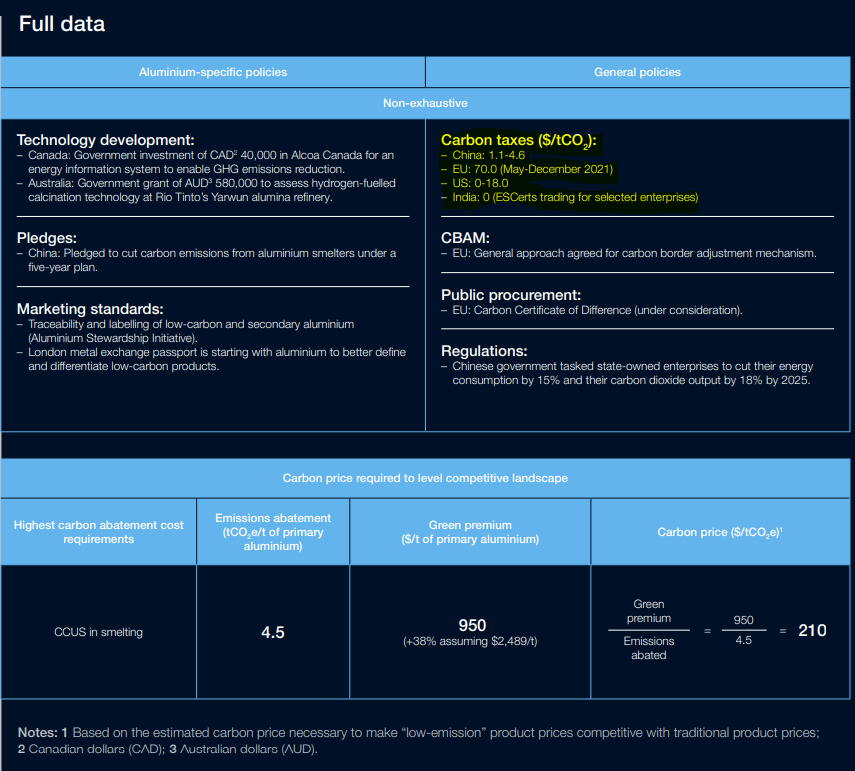

Carbon Price on Ammonia Proposal

With ammonia being essential to fertilizer used for growing food, the unelected globalists want to put a price on its carbon emissions, as it is “the chemical sector’s largest emitting product.”

“A $36-360 / tCO2e carbon price equivalent is required to level the competitive landscape” — WEF NetZero Industry Tracker 2022, Ammonia

“Ammonia demand for fertilizer and industrial use is projected to increase up to 37% by 2050,” according to the report.

The NetZero Industry Tracker 2022 suggests that “a $36-360 / tCO2e carbon price equivalent is required to level the competitive landscape, depending on technologies and geographies, and ‘carbon border adjustment mechanisms’ through international cooperation can help to prevent carbon leakage.”

“99% of ammonia production relies on coal gasification and steam methane reforming to make hydrogen” — WEF NetZero Industry Tracker 2022, Ammonia

“Ammonia demand for fertilizer and industrial use is projected to increase up to 37% by 2050” — WEF NetZero Industry Tracker 2022, Ammonia

“More than half of the world’s ammonia is currently produced in four countries: China, US, India and Russia,” according to the report.

What’s more, “99% of ammonia production relies on coal gasification and steam methane reforming to make hydrogen.”

“A green premium over 10% is too high to be passed on to farmers and consumers without impacting food security; further cost reduction is required to unlock additional demand” — WEF NetZero Industry Tracker 2022, Ammonia

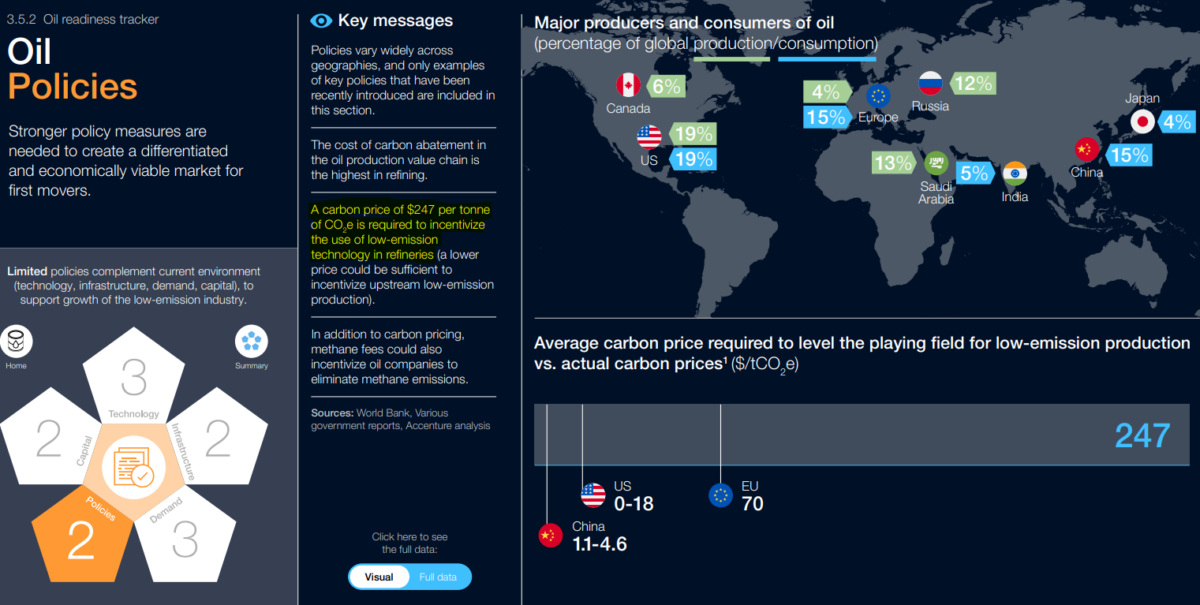

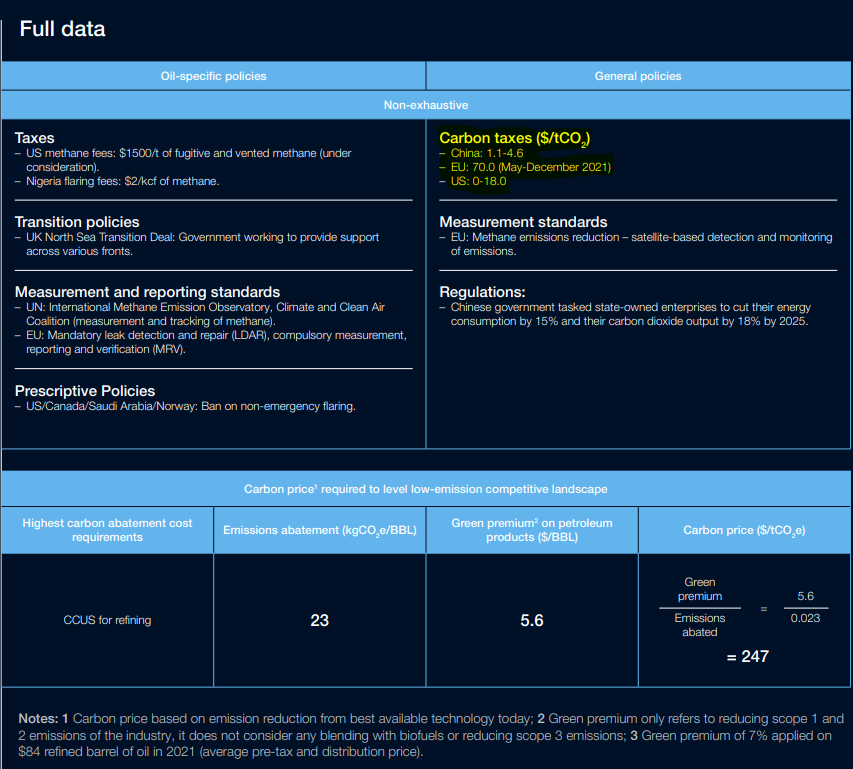

Carbon Price on Oil Proposal

With oil being “a driver of the global economy for the last 150 years,” the unelected globalists say that “$720 billion is needed to transform current oil production to low-emission.”

“A carbon price of $247 per ton of CO2e is required to incentivize the use of low-emission technology in refineries” — WEF NetZero Industry Tracker 2022, Oil

“In addition to carbon pricing,” the report argues that “methane fees could also incentivize oil companies to eliminate methane emissions.”

Overall, “A carbon price of $247 per ton of CO2e is required to incentivize the use of low-emission technology in refineries,” according to the unelected globalists.

“$720 billion is needed to transform current oil production to low-emission” — WEF NetZero Industry Tracker 2022, Oil

According to the report, “Approximately $25 billion is needed annually to transform the industry asset base by 2050.”

Additionally, “70% reduction in methane emissions can occur at effectively no cost to the oil companies (monetization of captured methane).”

Meanwhile, “At least $90 billion are required to scale the necessary low-carbon power, green hydrogen and CO2 handling infrastructure over the next 30 years.”

“Governments will need to strengthen producers’ confidence in their ability to pass a 6-10% green premium to end consumers while protecting poorer households” — WEF NetZero Industry Tracker 2022, Oil

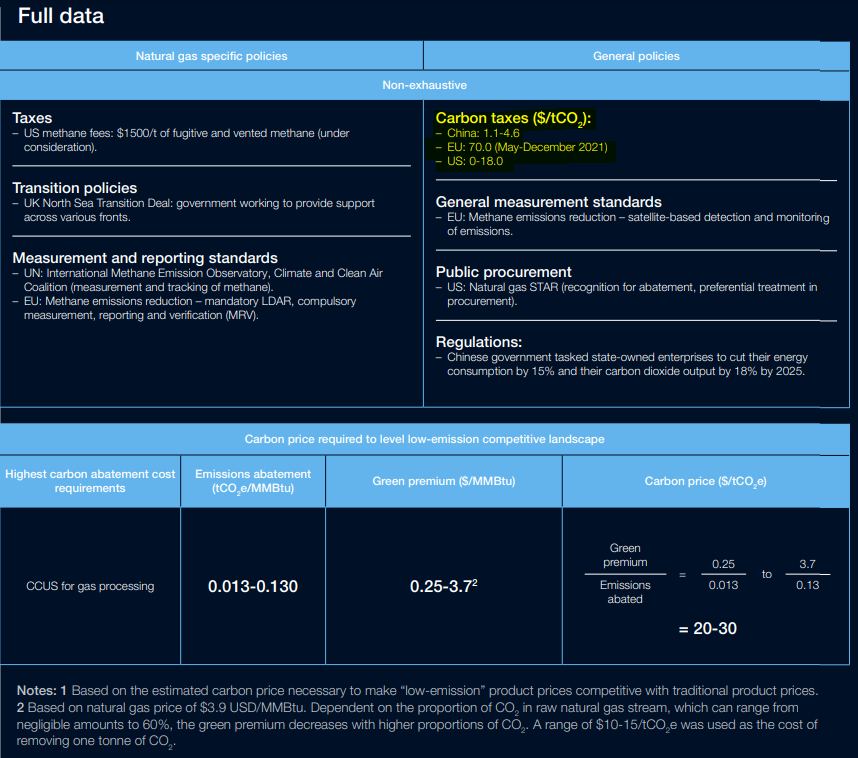

Carbon Price on Natural Gas Proposal

When it comes to natural gas, the US, Russia, Iran and Qatar produce over 50% of the global supply, according to the report.

“A carbon price of $20-30/tCO2e is required to incentivize low-emission technology in gas processing” — WEF NetZero Industry Tracker 2022, Natural Gas

Natural gas is also “a major energy source of modern society used in power plants (40%), industries (35%), residential and commercial buildings (21%) and as feedstock for petrochemicals (4%).”

Naturally, the unelected globalists want to put a price on natural gas carbon outputs, and for this they suggest, “A carbon price of $20-30/tCO2e is required to incentivize low-emission technology in gas processing.”

On the demand for natural gas, the report suggests, “Producers could pass a green premium of 1-3% to end consumers; however, governments should be cautious of this cost impact on poorer households.”

Overall, “More than $100 billion is required to scale the necessary low-carbon power and CO2 handling infrastructure over the next 30 years.”

“Producers could pass a green premium of 1-3% to end consumers; however, governments should be cautious of this cost impact on poorer households” — WEF NetZero Industry Tracker 2022, Natural Gas

“If, in the post-pandemic era, we decide to resume our lives just as before (by driving the same cars, by flying to the same destinations, by eating the same things, by heating our house the same way, and so on), the COVID-19 crisis will have gone to waste as far as climate policies are concerned” — COVID-19: The Great Reset, Klaus Schwab & Thierry Malleret, 2020

A Continuation of the Great Reset and The Great Narrative Agendas

During his speech at the Great Narrative Meeting in Dubai in November, 2021, WEF founder Klaus Schwab remarked:

“In order to shape the future, you have first to imagine the future, you have to design the future, and then you have to execute it.”

In 2016, the WEF imagined there would be a global price on carbon by 2030.

With the NetZero Industry Tracker 2022, the unelected globalists are now in the design phase of this future they are trying to create.

Next comes the execution.

Whether their carbon pricing proposals will have any dramatic effect on extreme weather or preventing global warming by the 2030s and 2050s remains to be seen.

The economic implications; however, have been spelled out quite clear in the report.

“The difference between ‘good governments’ and ‘bad governments’ will be measured by how fast they implement the transition to net zero while providing concomitantly a welfare policy that makes societies fairer and more prosperous” — The Great Narrative, Klaus Schwab & Thierry Malleret, 2022

The great narrative is the sequel to the great reset, which called for new social contracts, stronger governments, and a different form of capitalism that would make stakeholders richer and more powerful while people like you and I would own nothing and be powerless.

Then came the great narrative for humankind, which was an attempt to legitimize the unelected globalists’ technocratic agenda for a great reset of society and the global economy.

Tracking and putting a price on carbon for net zero compliance is a continuation of the great reset and great narrative agendas, and it will have a huge impact on society and the global economy.

Alibaba is already working on an individual carbon footprint tracker for its customers that will measure “where they’re traveling, how they are traveling, what are they eating, what are they consuming on the platform.”

“In order to shape the future, you have first to imagine the future, you have to design the future, and then you have to execute it” — Klaus Schwab, The Great Narrative Meeting, 2021

If the idea is to place a global price on carbon, then what would be the purpose of setting up a system to track carbon footprints if it wouldn’t be used to tax or otherwise punish those who refuse to comply?

Carbon taxes and credits will require the tracking of carbon emissions for both individuals and industry.

It is a system of coercion and control that runs the risk of leading to social credit.

Many will applaud the net zero agenda; others will resist it, and many others will be unaware of how much it will affect them personally because they can’t afford to play the long game of looking decades ahead — they have lives to lead and bills to pay that are far more pressing than worrying about the price of carbon emissions in a future where they are told they will “own nothing and be happy.”